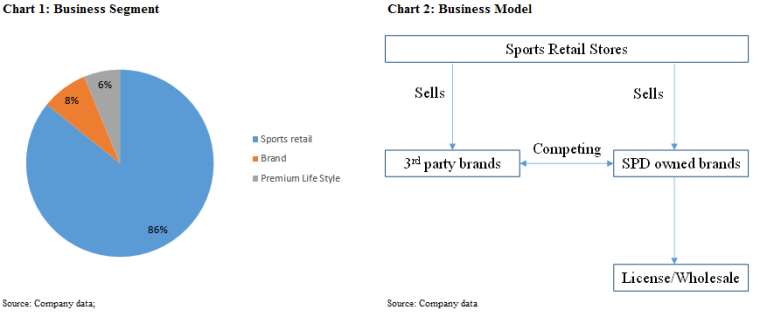

Company introduction

Naver is an internet company well-known for its domination in the Korean search engine market with over 70% market share. When the company was founded in 1999, there was a severe lack of Korean language content on the internet. Naver pioneered a system whereby it crowd-sourced information from its users through blogs and Q&A forums. Its portal became the largest news aggregator, integrating all newspapers’ content with its own commenting system. Its online shopping platform is one of the largest e-commerce business in South Korea and half of the population in the country use its online payment system. The company is ramping up its investment in AI, payment and cloud computing. Outside of Korea, it is the majority owner (~73%) of the messaging app, Line. Line has a dominate position in Japan, Taiwan and Thailand with over 200 million monthly active users. It also makes money from gaming and advertising.

Competitive advantage

Naver’s competitive advantage mainly comes from its closed system and control of the Korean language content. A customer can browse the news, searching for information, buying products and interacting with friends. There is no need to leave Naver’s platform. Google failed to compete on search because it cannot access the proprietary data, which represents a large portion of the Korean language content. With the first mover advantage and smart content strategy in Korea, it has become a habit to use Naver in people’s daily life. Culture differences also contributed to Naver’s domination. When buying a product or service, people in Korea put more value on their friends’ recommendation. Naver’s platform provides an easy way to search for relevant information.

Integration with its own online shopping platform is also a major competitive advantage. Search engine is a tricky business. Majority of the people who search online do not generate any revenue for the company. Money is made when the ads are clicked, helping those who instantly want to purchase something find the best provider. The best search engine does not automatically become the best ads business. If Amazon becomes the only online retailer, there is no need to pay Google to search. Having a strong e-commerce business ensures that Naver will always be a choice for customers even the ads shift to e-commerce sites.

Long-term growth potential

The main drivers behind Naver’s long-term growth will always be the continued penetration of e-commerce, online payment and digital advertising. Despite the dominant position in South Korea, one could argue that Naver has underutilized its assets. In terms of user data, Naver has a complete picture of its customers, including online activity, search history, online purchase, payment, social interaction, mobile location and user-generated content. It is almost a combination of what Google, Facebook, Amazon and Paypal can get. However, Naver’s technological ability is relatively limited vs. global giants, partial because of its strong market position that makes it less incentivized to invest. With proper investment, it has the potential to bring better advertising/recommendation and capture more value in the market. However, the size of the Korean language speaking population will always be a limitation to the ultimate scale that Naver can achieve.

Why it is mispriced

There are two major reasons that caused Naver’s stock price to be undervalued. 1) Heavy investment: if we look at Naver’s ecosystem in South Korea, core business (ads for search and e-commerce) generates a huge amount of cash without the need of investment. The platform generates strong positive network effect. Marginal cost for additional ads on the platform is very low. New investment (categorized as expenses) was mainly in the payments, AI, new initiatives and most importantly hiring more engineers. If we believe that Naver’s asset is underutilized, the increased investment is the right long-term strategy for the company. 2) Short-term political issue: because of its domination in the news and social media, Naver was accused of opinion-rigging and fake news that indirectly influence the last presidential election. There are worries about potential regulation that can impact the company. But it is also a testament of the power it possesses.

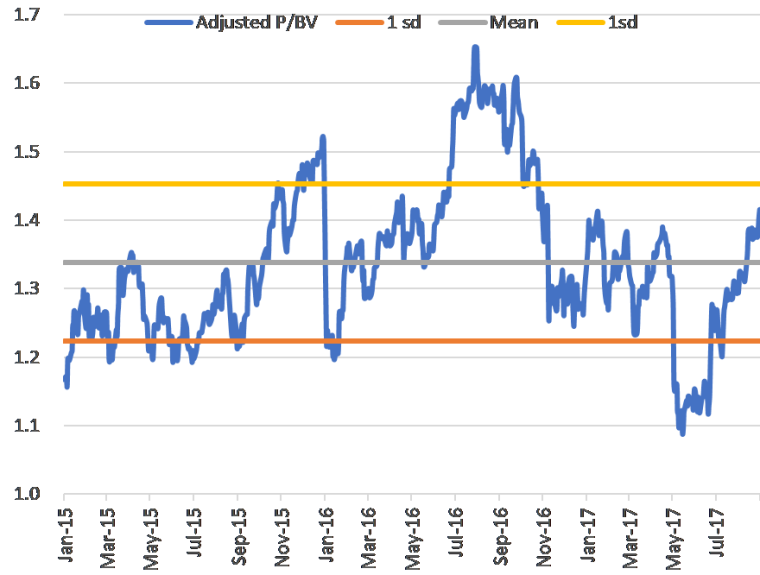

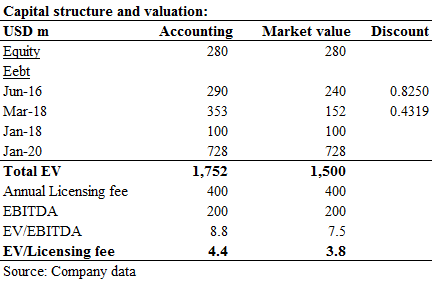

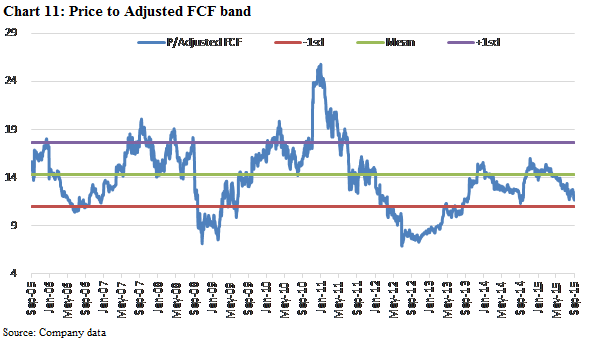

Valuation

In 2017, Naver’s core business in Korea generated revenue of KRW 3T (~$3bn) with operating margin of around 35%. And it was growing at ~15% annually. 25% of revenue was invested in R&D. If we apply a normalized 12% R&D to revenue ratio, which is the historical average for US tech companies to maintain market positions, Naver’s after tax earnings would be ~KRW 1T ($1bn). With a market cap of ~KRW 16T (excluding 4T net cash), Naver is trading at 16x normalized earnings. If we further subtract its 73% stake in Line, valued at ~KRW 6.5T, from the market cap. Implied core business in Korea is only trading at less than 10x.