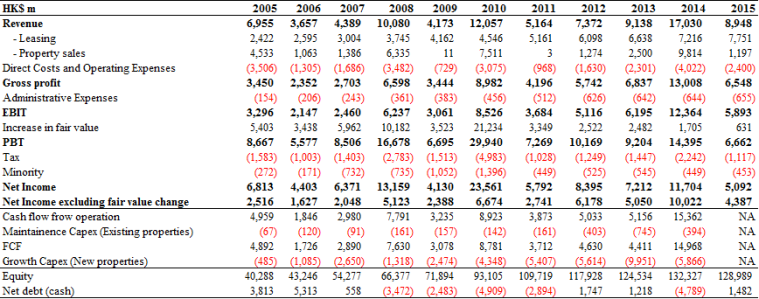

Summary: Hang Lung is a developer in Hong Kong, China, focusing on property development, leasing and sales. The company uses a unique business model with almost no debt. It grows free cash flow (FCF) through the long-term holding of the best commercial properties in several promising cities. It is occasionally involved in residential property development on a counter-cyclical basis. The company is in the process of repeating its business model in seven of China’s second-tier cities and is expected to significantly increase its FCF over the next decade. A valuation of 0.51x P/BV is not expensive, but the incoming problems in China will provide better opportunities for long-term investors.

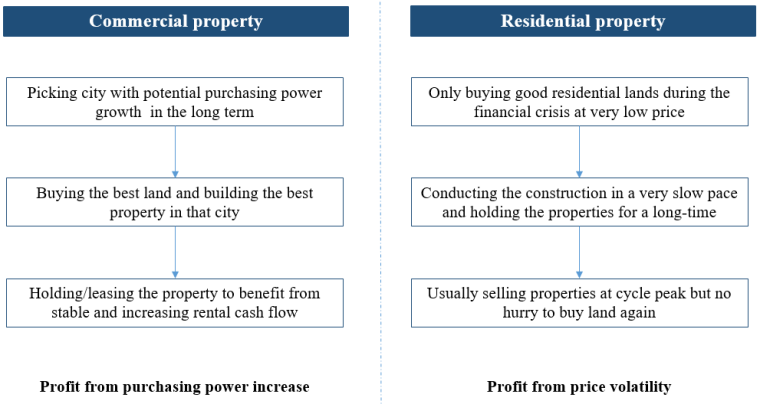

Unique business model as a property developer

The current management took control in 1991. At that time, Hang Lung was not that unique and its portfolio mainly consisted of shopping malls, office buildings and residential apartments in Hong Kong. Since then, the management has used the cash flow from those properties to pursue two unique strategies. For most of the property developers around the world, their businesses usually include buying land, developing the property and selling the final products. Those low-margin businesses depend on debt financing and a high turnover rate to achieve a reasonable return. Eventually, companies encountered trouble when property prices declined. That was the case for U.S. developers in 2008, and that was truer for emerging market developers who faced much higher volatility. However, Hang Lung has a completely different business model. It made profits from its long-term purchasing power increase and price volatility. Its two main business models can be summarized in the following chart.

Source: Company data

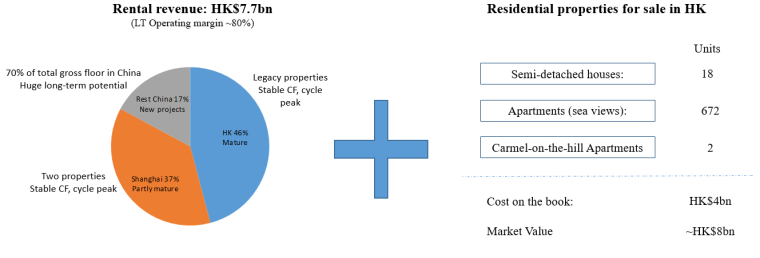

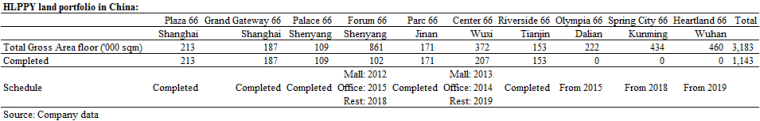

Hang Lung has two business segments: property leasing and property selling. In 2015, its property leasing revenue reached HK$7.7bn (87% of total). Within the property leasing segment, HK$3.6bn came from Hong Kong, HK$2.9bn came from two properties in Shanghai and HK$1.3bn came from 6 other properties in China. Property sales segment were much more volatile because of the company’s strategy to be contrarian and opportunistic. Annual property sales range from zero to HK$10bn in the past decade. By the end of 2015, Hang Lung had 692 units available for sale booked at the cost of HK$4bn.

Source: Company data

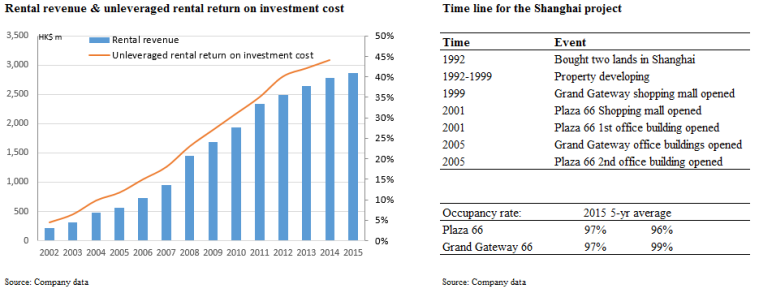

Success in Shanghai can be repeated

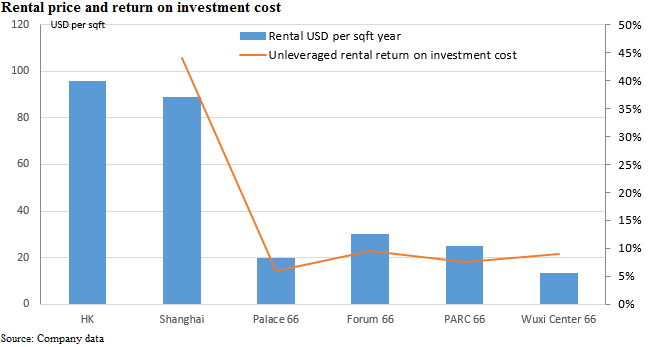

The best way to understand Hang Lung’s property leasing strategy is to look at its two projects in Shanghai. The philosophy of the management team is easy to understand. The company’s success depends on picking a promising city at the early stage of growth, buying land at the best locations at low prices; building the best property and having the best team handle the leasing. In Shanghai, the company bought the land in 1992 and the operations started around 2000. Since then, rental revenue has surged with the purchasing power of consumers. Annual rental revenue now represents ~50% of the total accumulated investment cost (HK$6.3bn), translating to a ~30% net return on investment. Once the property is completed, maintenance capex is very limited compared to cash flow. Although the property cycle can be volatile, the best location and quality with no debt ensures that there are very limited competitors in the long term.

From 1992 to 2005, those two properties were the only assets in China for Hang Lung because the management insisted on only doing the projects that met all their criteria and maintaining minimum debt. During 2005 and 2007 when the property market in China was experiencing a downturn due to government policy, Hang Lung found the mix it wanted and expanded its land portfolio into 7 new cities.

Since 2010, new projects in those cities have gradually started operations. Although the new/potential projects have a much larger combined gross area floor vs. 2 projects in Shanghai, rental revenue is only half of Shanghai’s. However, from the return on investment point of view, its average 8% is higher than 5% when Shanghai properties opened. It has the potential to capture the purchasing power growth in second-tier cities in China over the next decade.

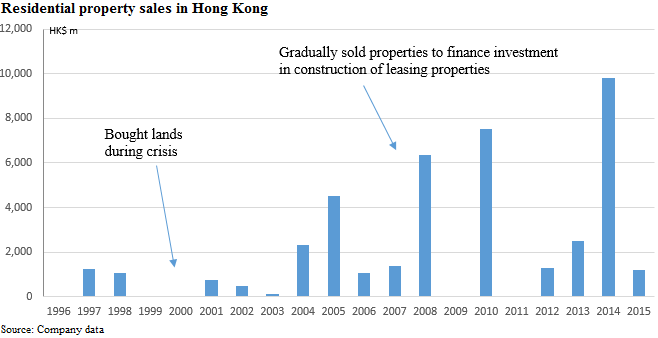

Contrarian in residential development

Unlike normal property developers who make money from a high turnover rate, Hang Lung occasionally entered into the residential development market in Hong Kong. The company holds a contrarian view on this segment of the business. Because the company usually maintains a net cash position, it bought land during the financial crisis when no one had enough cash and sold properties gradually along the cycle and partially financed its investment in property leasing. During 1999 and 2001, the company bought a huge amount of land at very low prices. Since 2001, property sales have contributed ~HK$40bn to revenue with a margin over 70%. The company still has 692 units in inventory available for sale valued at over HK$8bn at the end of 2015.

Why no one can copy it

We already know that the keys to success in Hang Lung’s business model are: Location + Quality + Team + Identifying promising cities + Low land price = Success. Every emerging market property developer knows that location and quality are important. They also know that price is volatile and debt can be a problem. But there are some unique factors for Hang Lung’s management and strategy to create a deep moat around its business.

- Disciplined management team: While it is easy to figure out the keys to success, it is a completely different story to stick to it. Hang Lung has shown an amazing track record by strictly following those criteria. In the years before the 1997 Asia financial crisis, management was selling properties to raise cash and refusing to buy any land when analysts accused it of being over conservative. During 1999 and 2001, the company was aggressively buying land when analysts accused it of being too optimistic. It was the same when Hang Lung bought more land in China from 2005 to 2007. Each time, management ignored the market’s demand and made the right decision.

- Best location + property: The biggest difference between Hang Lung and other developers is the intention to be the long-term holder of the best properties. While a leveraged developer of a mediocre shopping mall is subject to fierce competition, a well-built shopping mall in the best location of an emerging city operated by a great company with no debt can be an exposure to the purchasing power increase in the long term.

- Brand: It may initially sound counter-intuitive that it can be a good thing to open a shopping mall during a downturn or a crisis. But it is definitely the case for high-end stores (especially for emerging market cities). Hang Lung’s properties in Shanghai provide the best example. When there were no competitors, Hang Lung set up its brand as a representation of the highest-end shopping mall. In the following years, it reaped the benefits of rising purchasing power. Moreover, the ‘Hang Lung’ brand has become a very effective tool for the company to expand to second-tier cities.

- Relationship with global brands: It is not exaggeration to say that the global luxury brands came into China hand in hand with Hang Lung. In the early days, you could find the flagship stores of most luxury brands in Shanghai’s Plaza 66. Through years of cooperation, Hang Lung has cultivated great relationships with global brands. You can now find similar brands in Hang Lung’s new projects in second-tier cities. Hang Lung has clearly positioned itself as the host of global high-end brands and there is massive growth potential in the long term.

Short-term headwinds from economy and property cycle

Despite its long-term potential to profit from a purchasing power increase, Hang Lung will face some headwinds in the coming years. The problem of the Chinese economy is an obvious one. The cyclic downturn in the Hong Kong property market will also add pressure to both property sales and rental revenue. Corruption in the local governments can make trouble for the company. However, with a clear focus on creating long-term value and a very strong balance sheet, Hang Lung can turn troubles into opportunities.

- China Economy: As I have mentioned in my past articles China Rate Cut: Unintended Consequence – May 1, 2015 and China Update: Equity market crash is just a tip of the iceberg – Aug 24, 2015, there are significant risks in the next several years in China. Overcapacity in the property sector and over-investment in infrastructure are the core problems. The company may face pressure from currencies, rentals price and property valuations. However, investors should clearly separate highly leveraged properties that face significant competition with similar properties from those that have real competitive advantage and can differentiate themselves in the market. Either through a soft landing or a hard landing, China will eventually shift to a more consumer-focused economy. This will be positive for an unleveraged Hang Lung in the long term.

- Property Cycle: Property prices have been moving in big cycles, especially in the emerging markets and are highly correlated with the monetary policy. The rising dollar has started to put pressure on the property sector and the investors may see lower rental revenue as a result. But the volatility of the rental revenue is much lower compared to that of the property prices, especially for the best properties in a city.

- Corruption: Among Hang Lung’s 7 projects in China outside Shanghai, 1 project in Tianjin met a problem related to corruption. While Hang Lung bought the best land and built the best property in the city, the local government used a lot of safety regulations to delay the project. At the same time, a company that has a deep relationship with the local government was able to start operation 18 month earlier than Hang Lung and grabbed some top luxury brands. Hang Lung had to change its strategy to start with slightly lower-end brands. Although the return on this project is similar to other 6 projects, it clearly could do better.

Valuation

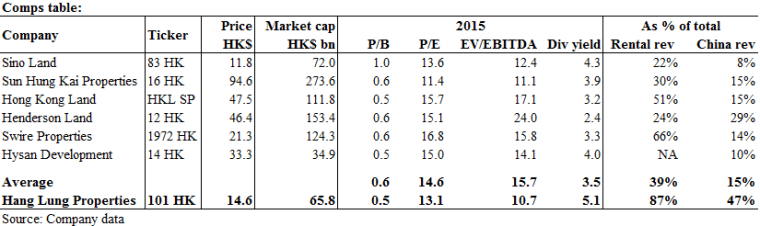

According to accounting rules in Hong Kong, companies need to revalue their property-for-lease annually and mark to market. Hang Lung is currently trading at 51% of its 2015 year-end book value vs. 62% of peers. It is interesting that the discount to book value have completely wiped out all the revaluation gains since 2005. It means the investors are literally buying most of the assets at 2005 cost. Considering management’s conservative nature and the amazing property price surge in the past ten years, Hang Lung’s valuation is not expensive even there is a property market crash. Hang Lung is also uniquely positioned within the property sector. Comparing to listed developers in Hong Kong which also has relative low debt, Hang Lung has a higher exposure to China (47%) and more revenue from stable leasing (87%). At the same time, most of the mainland developers are heavily in debt.

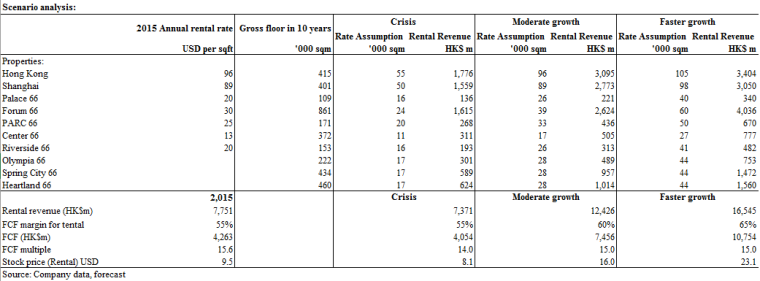

It is very hard to predict when and how the property bubble in China will burst in the short-term. But for a company with almost no debt and predictable management team like Hang Lung, it is easier to look into the long-term. Below is a scenario analysis on the rental part of the business. This excludes the 692 units of mostly sea-view apartment inventory in Hong Kong (~HK$8bn) and potential more investments by management during the future crisis.

Although Hang Lung’s Hong Kong portfolio may only be categorized as of normal quality, its China portfolio consists of best properties at best locations in cities with over 10 million people. The assumed annual rental rate is still much lower vs. comparable properties around the world. Market’s worry about a hard landing in China is justified. But adjustment to a consumer focused economy even through hard landing will be positive to Hang Lung in the long-term. Managements’ track record suggests that they will definitely use the strong cash flow and balance sheet to take advantage of the crisis. This is the case when long-term investors should be happy to see a crash.