Summary

PWE is one of the largest conventional oil and natural gas producers in Canada. For years, its previous manager increased debt to pursue high production growth without cost in mind. New management took control in mid-2013 and started the plan to bring down debt and improve efficiency. But share price declined 80% in the past year as oil price and legacy problems hurt the company during the change. However, strong management with focus on low-cost oil assets will help PWE survive the oil downturn and current distressed valuation is not justified.

Investment Thesis

- Strong Management and well turn around execution

The new managements took control in mid-2013. Since then, they have achieved all of their stated targets in operation improvement. Non-core assets of over CAD1bn were disposed to bring down debt from CAD3.2bn to ~CAD2bn. Annual cash cost decreased CAD400m. Previous practice of expensive acquisition immediately stopped. They cut 25% of the workforce and turned the company to focus on efficiency. Management voluntarily disclosed an accounting issue in mid-2014 and finished a full review by Oct 2014.

- Misunderstanding about true earnings power of the company

Due to previous management’s expensive acquisition, current non-cash cost was inflated and did not reflect the long term cost structure of the company. Management’s decision since 2013 to focus on 3 conventional oil assets prepared the company for the low oil price. Unlike shale oil companies, which need to constantly drill new wells to keep production, conventional players can rely on old wells for more years. PWE has a total reserve of 487MM boe with current annual production of ~10% reserve. The long term total cost will gradually decline to around $30/bbl and ensure the survival during the downturn.

- Debt problem exaggerated, equity and bond valuation mismatch

Debt is the main concern in the market for PWE. Net debt/EBITDA may temporarily breach the debt covenant. However, management has reached an agreement with bondholder to relax covenant in next 2 years. Considering the 30% Net debt/Equity ratio, strong reserve base and further cost structure improvement, the company has enough room to cover the debt. Moreover, Pennwest’s bonds are traded above par at a healthy yield while equity is at a distressed level.

Valuation

PWE is currently trading at distressed level with EV/Reserve at $5.3/bbl, significantly lower than $15/bbl finding cost and its historical average of $18/bbl. Price target of $3.5 is based on $9/bbl EV/Reserve exit downturn in 2 years with 20% of reserve decline. However, it is very likely for EV/Reserve to eventually reverse back to above cost of finding in the long term.

Company Overview

Penn West Petroleum (Pennwest) is one of the largest conventional oil and gas producer in Canada. The company was founded in 1979 with headquarter in Calgary, Alberta. In 2005, Pennwest, along with many other Canadian oil and gas producers, transformed itself into a Canadian Royalty Trust which distributed all income to avoid federal income tax. However, in 2011, Pennwest eventually converted back into normal company after government regulation.

Pennwest mainly operated in three conventional oil & gas field in Cardium, Viking and Slave Point with an annual production of around 100k BOE/d. At the end of 2014, Pennwest’s net proven and probable reserve totaled at 487m BOE.

Why this is a good company

Because the oil price cannot be set by any individual company, the E&P business is generally a price taker and the success is based on low unit cost. The combination of low-cost-to-produce asset and a strong management that focus on efficiency is the formula to long term value creation.

- New management team with a strong track record

The current management team took control in mid-2013. It has a very strong track record of creating long term value for shareholder and is well-known for its efficiency orientation. Since 2013, underlining operating performance has improved significantly. Cash run rate has been coming down dramatically, drilling time has been cut in 3 major plays and most importantly uneconomic production has been shut down. The management has adopted a shrink-improve-expand process and further improvement is likely to be realized in the coming years. Core management team member include:

Chairman – Richard George: Previously CEO of Suncor Energy from 1991 to 2012. He built the company from a small regional producer into Canadian’s largest energy company with over $50bn market cap. During his 21 year period, company generated a compound annual return of above 20%.

CEO – David Roberts: Previously COO of Marathon Oil from 2008 to 2013. He was in charge of the E&P business of Marathon Oil and was good at improve efficiency. Under his management, Marathon oil recorded improving operating matrix constantly from 2008.

- Low cost to produce conventional oil assets

Conventional crude oil in Canada competed with both US shale oil producers from Bakken and Cushing. The growing supply in US shale oil production has made the Alberta crude to trade at significant discount to WTI. However, even with the price discount and larger transportation fees, the conventional producer from Canada still has advantages over its US shale competitors: 1) Cost to produce for conventional oil can be as low as under $30/bbl while shale producers usually has a higher than $50/bbl cost; 2) Conventional oil producers does not need to continuously drill new wells to keep production relatively stable while shale players face a much faster production decline; 3) As more light crude oil can move to new refinery capacities from the Gulf area, the competition will gradually ease and the discount is likely to shrink. As an of the largest conventional producer, Pennwest is set to be more competitive in a low oil price.

Why it is undervalued

Pennwest stock price has declined over 80% in the past year due to market perception of it as a high-cost producer, concern of its debt level, and a self-revealed accounting issue. However, a detailed look at the fundamentals shows the concerns resulted from market misunderstanding and exaggeration. The company’s distressed level valuation is not justified.

- Market perception of it as a high-cost producer

Although Pennwest sits on top of an attractive conventional oil & gas assets, previous management did a poor job by overpaying on the acquisitions to grow production without cost in mind. New management took control in mid-2013 and immediately stop the bad practice. The disposition of non-core assets and 25% reduction in work force set the stage for Pennwest to convert to a low cost producer. However, the previous expensive acquisition (Finding & Development cost which is capitalized) and the short term decline in production masked the true long term earnings power of the company. Furthermore, the decline in oil price has exaggerated the market misunderstanding. The new focus on self-developed reserve in low-cost area will result in total cost per barrel to decline to around $30/bbl. This will give Pennwest a significant advantage over its main competitors, the US shale oil producer.

- Concerns of the debt level

Another negative impact from previous poor management is the debt used to support growth. Under current market situation, market is correct to worry about the debt of the company. However, there is a huge mismatch emerging from the debt and equity market for Pennwest. The stock price is clearly trading at distressed level and indicate a high probability of default while all company’s debts are trading above par and at a healthy yield.

After taking control in mid-2013, the new management started debt reduction through selling non-core and high-cost assets. Net debt level has declined $1bn in the past year. Absolute debt/equity level is not high at 30% but the concern is on debt to EBITDA level. The ratio is likely to temporarily breach the covenant of 3x due to oil price decline. But company has already reached an agreement with the banks to waive the requirement in the short-term. And for the long-term, the cost saving method combined with $1.7bn unused credit line can help company go through the downturn.

- Accounting problem

In Q214, management voluntarily disclosed a minor accounting problem. Some expenses were misallocated to CAPEX/royalties for 2012/13 period and management team initiated a full scale internal accounting practice review. The review has been completed in Sep 2014 with operating cash flows of 2012/13 restated lower by 5%/7%. But reserves and other major balance sheet items were reaffirmed by a third party. It ensured the company a clean start under the new management. However, the damage has been done just before the oil price decline and this is also a contributor to current lower valuation.

Valuation & Comps

Normally, it costs around $15/bbl to find new Proven and Probable reserves especially for light crude oil. Pennwest used to be traded in the past decade at an average valuation of $18/bbl EV/Reserve which reflect reasonable return above finding cost. Currently, the stock is trading at only $5.3/bbl EV/Reserve which in the long-term is not sustainable. The base case price target of $3.5 is derived assuming $9/bbl EV/Reserve exit downturn in 2 years with 20% of reserve decline during the period. The bear case PT of $1.6 assumes 30% decline in reserve before oil market stabilize. And the Bull case assume 10% reserve decline but a reverse back to $15 finding cost for EV/Reserve.

Besides the low EV/Reserve vs. historical average, Pennwest has the lowest multiple among major Canadian E&P companies, even lower than those companies with worse balance sheet and less light crude reserve.

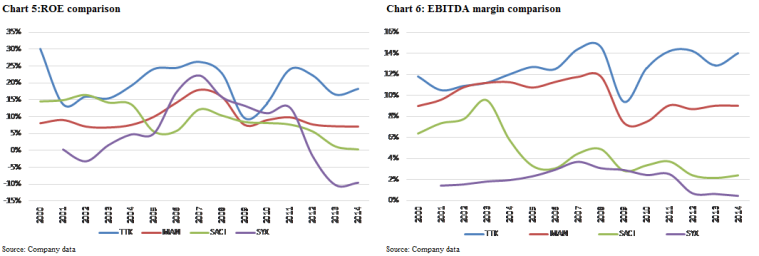

Table 2: Comps of valuation, operating and financials among Canadian oil E&P

Conclusion

Pennwest, with its strong management and conventional oil assets, is severely mispriced because of misunderstanding of its true cost structure and exaggerated concern over debt problem. The oil price decline, management strategy to shrink operations with unhedged oil and legacy accounting problem also helped create this distressed level valuation. In the long run the EV/Reserve is very likely to reverse to underlying finding cost. On top of the misprice, Pennwest also has the potential to turnaround and become a long term winner in a low oil price environment.