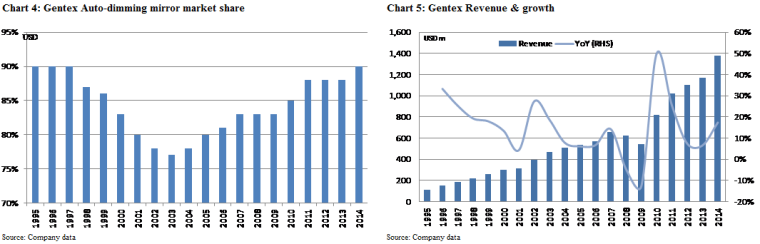

Summary: Gentex is the inventor of auto-dimming rearview mirrors and is the dominant manufacturer with a 90% market share. The company maintains the highest margin in the auto-parts industry because of its technology, manufacturing process, and patents. Gentex generated stable free cash flow with limited maintenance capex requirements. Significant growth potential still exists as global penetration rate of auto-dimming mirror is increasing from the current 27% level. Gentex’s 14% revenue exposure to Volkswagen caused Gentex’s stock to decline recently, but fundamental earnings power is still intact. Current valuation of 2014 PE at 15x underestimates the company’s strong competitive advantage and growth potential.

Investment Thesis

- Dominant player with the highest margin in the auto-parts industry

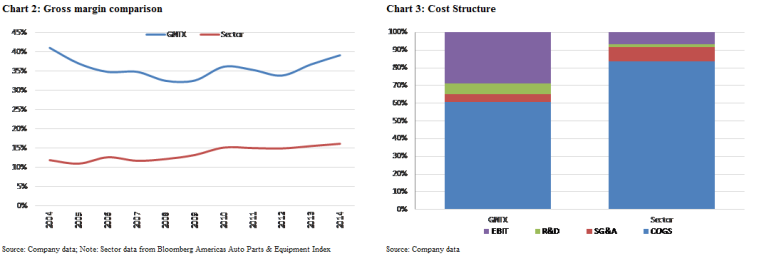

Gentex’s gross margin of ~38% in the past 25 years is among the highest in the auto-parts industry. Gentex won its battle with its only competitor, Donnelly, with its unique manufacturing process, which resulted in better quality and reliability and a patent lawsuit. Even after Donnelly was acquired in 2003 by Magna, which is much larger in size, Gentex continued to gain market share. Its strong competitive advantage is also supported by a completely non-unionized labor force, lack of pension liabilities, and a unique incentive plan that gives 90% of the stock options to non-executive employees and requires executives to hold the company’s stock in an amount that is 3x their annual salaries.

- Growth potential still significant as technology penetration increase

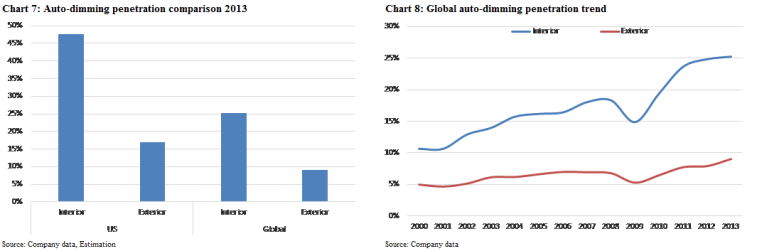

Despite volatile vehicle sales in the past decade, Gentex’s revenue has continued to grow as the global penetration of auto-dimming rearview mirrors increased from 16% to 27%. The trend continued to accelerate from interior to exterior mirrors and from the United States to the global markets. In addition, Gentex was able to expand its auto-dimming technology into the aerospace sector with annual sales growth of +50% in the past three years due to putting its mirrors on the Boeing 787. The increase of penetration of auto-dimming technology in the automotive industry alone is likely to provide the company with +10% annual revenue growth in the next five years.

- Strong FCF but investment in the electronics businesses is a concern

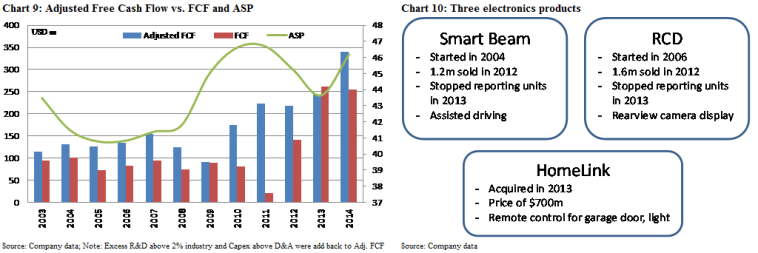

Almost all of Gentex’s growth in the past was funded internally, and the company has always maintained a net cash position since its IPO. It generated fast-growing FCF with limited maintenance capex needed. However, management’s mindset to invest in the vehicle-related electronics businesses to counter annual price declines is a concern as Gentex does not have long-term competitive advantages in those businesses. It will be better capital allocation for Gentex to focus on widening the application of its mirrors.

Company Overview

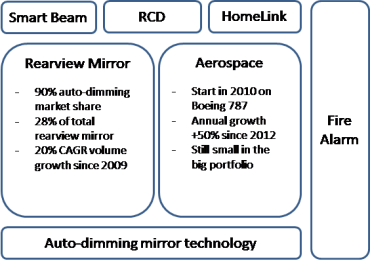

Gentex is an auto-parts manufacturer in Zeeland MI. Its core technology is the auto-dimming mirror that it invented in 1982. Since then, it has built several businesses around this technology. The company started with rearview mirrors for vehicles and dominated the market with a 90% share. In 2010, the company entered the aerospace business by putting the auto-dimming mirrors onto Boeing 787s. Gentex also built new features on the rearview mirrors like assisted driving, video display, and garage door control to better utilize the screen. Besides the main business, Gentex also manufactures fire alarm equipment. This is a high-margin business but only contributes 1% of Gentex’s revenue.

Chart 1: Summary of core businesses

Gentex has built the company to achieve an owner mindset throughout the company. There is no multi-layered reporting structure and every employee is empowered by several unique settings.

- Management team: CEO/Chairman Mr. Fred Bauer (72) is the founder of the company and hold 3% of its shares. He maintains a low profile and mainly focuses on running the business in the long term. Although the company gives guidance on its annual performance, the CEO rarely talks to analysts or grants interviews. The management team has a strong track record of growing organically and good capital allocation.

- Incentive plan: Gentex has a broad incentive plan to align the interest of employee with the shareholders. Compensation at the executive level is reasonable. Over 90% of the stock options are granted to non-executive-level employees with the grant-date market price as exercise price vesting over five to seven years. All executive-level officers are required to hold at least 3x their annual salaries in the company’s stock.

- Labor force: Unlike its peers in the industry, the workforce in Gentex is not unionized and there is no pension liability. Combined with the incentive plan, this structure has created an ownership mentality across the whole company and aligned the interests of the employees with those of the shareholders.

Competitive advantage

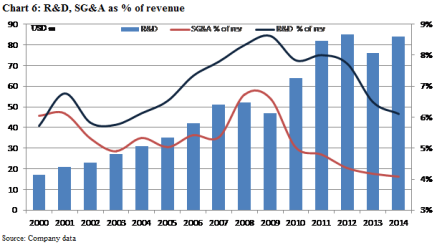

For the past 25 years, Gentex’s gross margin level of around 38% has looked more like Apple than an auto-parts manufacturer. The consistently higher margin resulted from the long-term building of a competitive advantage around technology, process, and patents. The company invested heavily in R&D to maintain its leading position versus competitors, and it enjoys a much higher operating margin as well.

- Advantage in quality and reliability

Since the invention of auto-dimming mirrors decades ago, Gentex has always had a strong hold on the automotive rearview mirror market. In the early 2000s, Donnelly, the only competitor, caused some troubles by imitating the product and gaining market share. In 2003, Donnelly was acquired by Magna, which has much larger resource than Gentex. However, it turns out that the product from Donnelly has serious reliability problems after several years of usage. Automakers gradually shifted back to using only Gentex’s products. Even Magna was not able to resolve its problem despite its vast resources after the damage was done to its reputation. Gentex also protects its technology with around 500 U.S. patents. Moreover, its unique manufacturing process has contributed significantly to its lead in quality and reliability.

- Economies of scale

Because of its dominant market control in the fast-growing, auto-dimming rearview mirror market and high R&D rate, Gentex was able to maintain its technology and expend into other areas like aircraft mirrors. In the meantime, SG&A as a percentage of revenue constantly declined as volume grew, further expanding the operating margin.

Growth potential

Despite the fast growth in the past 20 years, the penetration rate of auto-dimming technology is still at a relative low level on a global basis. Gentex will continue to enjoy the increasing adoption of its technology on both vehicles and aircraft.

- Automotive rearview mirror

The market penetration started with interior mirrors in the United States and spread to exterior mirrors and the global markets. The global adoption rate is likely to continue to increase, providing strong support for Gentex’s revenue growth regardless of the total vehicle sales, which can be volatile.

- Other growth potential

A new potential area for auto-dimming technology is the application of mirrors on aircraft. Gentex has started to provide auto-dimming mirrors for Boeing 787s and some high-end business planes. Although the revenue contribution is still small (~2%), this segment has been growing +50% for the past three years and presents a potential growth engine in the long term. Besides the new application of its technology, Gentex has also been adding new features to the existing mirrors. The recent acquisition of HomeLink is expected to provide some meaningful growth potential to the company.

Concerns about the company

- Return on R&D and acquisition

Most of Gentex’s growth was organic, enabling the company to maintain a fast-growing FCF and a net cash position since its IPO. The requirement for capex was limited to maintain the moat in the mirror business. But the efficiency of the R&D (6%–-8% revenue) and an acquisition were questionable. Gentex used those investments in add-on features to counter the annual price declines negotiated with automakers. However, this strategy resulted in reinvesting cash into electronics businesses in which Gentex does not have a long-term competitive advantage. In the past decade, Gentex had three major product offerings in this category and two have failed to meet expectations. The initial success and high margin quickly faded under the fierce competition. The third product, the $700 million acquisition of HomeLink, has a similar problem.

Although Gentex is known as an auto-parts manufacturer, its core competitive advantage is in technology and processes to make its mirrors. It is better for the company to reinvest the cash flow to find more applications for its mirrors. And lowering the R&D expenses may be a more efficient capital allocation decision to maintain the margin. Management’s mindset to focus the investment on the electronics businesses within the auto industry is a concern for the investors as those electronic products with high margins will eventually face more competition in the market.

- Volatile auto market and impact from Volkswagen scandal

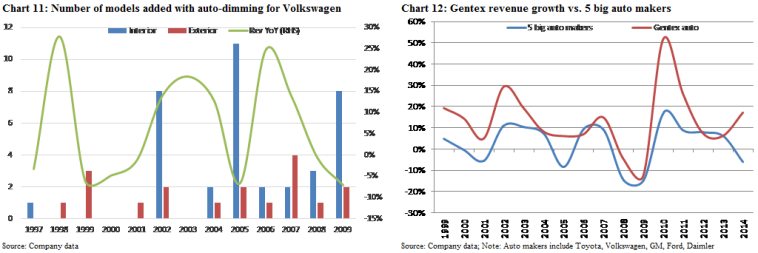

Contrary to the general perception that a healthy auto market drove up the penetration rate, it was actually during the downturn that automakers added new features because of the competition. For example, Volkswagen added an interior auto-dimming mirror to most of its models in 2002, 2005, and 2009 when its revenue declined. As a result, Gentex’s growth followed a pattern of penetrating into more models during the bad times and reaping the benefits during the recovery. The recent slowdown in the emerging market can be a potential hit to the short-term earnings but will also be a catalyst to increase the penetration on the global basis. Channel checks with purchasing managers from China automakers confirm the increasing competition and the need to add potential features.

In terms of Volkswagen scandal, because most of the models involved adopted auto-dimming technology around 2003 and all of its major competitors have installed the technology long ago, the decision to shift purchases from Volkswagen will not have a big long-term impact on Gentex.

Valuation

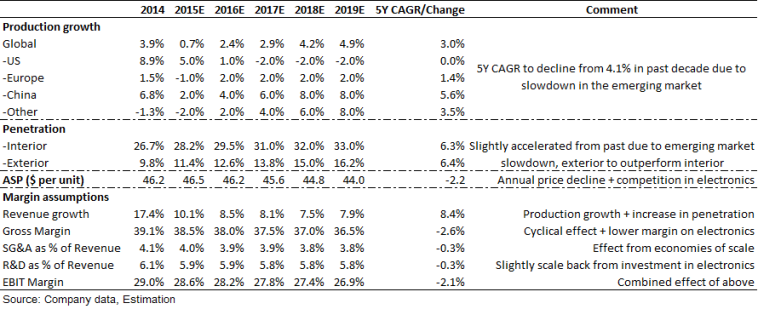

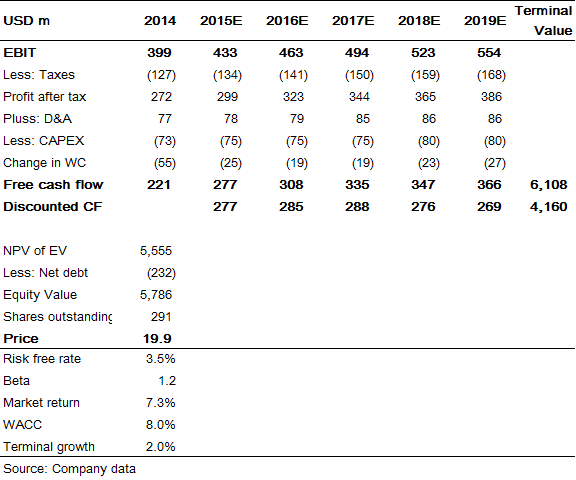

- Assumptions and DCF

PT of $20 was based on a lower global production CAGR in the next five years while the penetration rate increases. The model is also based on the assumption that the gross margin will decline cyclically, but the SG&A and R&D as a percentage of revenue will improve. DCF was based on a WACC of 8% and a terminal growth rate of 2%. The Table 1 summarizes the major assumptions and the reasons behind them.

Table 1. Assumptions

Table 2. Market Implied Valuation from DCF

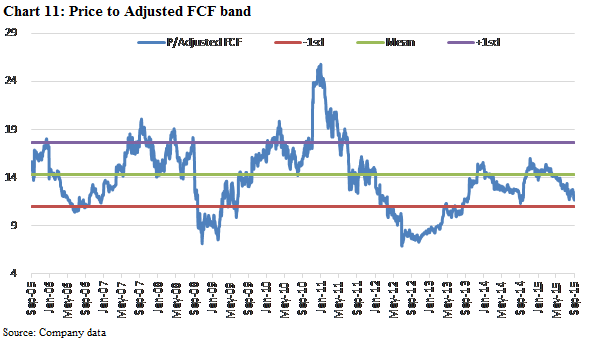

- Sustainable Free Cash Flow and multiples

Because of heavy growth investment in R&D and the acquisition, a better measurement of the company’s sustainable free cash flow (FCF) is to exclude part of the R&D. The company’s sustainable FCF actually comes from two parts: 1) the mirror business is protected by strong moat (80%) and 2) the electronics businesses are highly competitive (20%). Adjusting for volatile items, P/Sustainable FCF is trading at 11.7x, which is close to the lower end of the historical level. Considering the extreme case of losing all the electronics business and reversing to industry-normal R&D level, Gentex would still maintain its moat because of the existing technology, processes, and economies of scale. Then, the company would be trading at 16x FCF. Despite the distraction from non-core businesses, Gentex has not weakened its competitive advantage during the reinvesting process. The company will still have the potential to benefit from increasing penetration of the auto-dimming technology in the auto market and other industries like aircraft.