Download PDF report here: PWE – Comment on Asset Sales

I first wrote about this company last year. At that time, it was a kind of deep value play. The company had huge amount of debt and much more assets than they can develop. Despite having enough good assets to cover the debt, market treated it as a candidate for bankruptcy. On 10 Jun, PWE announced selling of its Dodsland Viking asset for CAD$975m (vs. ~CAD$500m reported by Reuters a week ago). Including the disposal of other non-core assets in 2016, PWE brought down its debt from CAD$2.1bn to CAD$600m. After suffering two years from low oil price and high debt, PWE finally finished its transition to a low cost producer with strong balance sheet and huge growth potential. Despite an impressive 37% increase in stock price after the deal, the company is still severely undervalued and posed to outperform in both the short-term and long-term.

Background information

PWE was one of the largest conventional oil and gas producer in Canada. Before 2013, the previous management did a poor job by focusing too much on land accumulation. This left the company with massive land beyond its capacity to develop and over CAD$4bn debt. Since 2013, the new management team (from Suncor and Marathon) has been focused on improving the cost structure and selling non-core assets to bring down the debt. However, the declining oil price has put enormous pressure on the company since 2014. It had to renegotiate its debt covenant in 2015. Although most people agree that PWE has some good assets, the word ‘bankruptcy’ was in most of the company’s news recently.

Asset sales has eliminated most of the debt

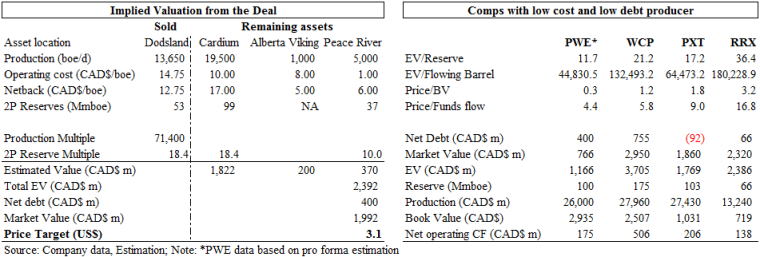

The deal was a complete surprise to the market and a game changer to PWE. To make it simple, PWE has three core assets of good quality. Two (Cardium and Dodsland Viking) have already been in production and one (Alberta Viking) is in the initial stage. The selling of the relatively smaller Dodsland asset has significantly reduced PWE’s outstanding debt. Moreover, management indicated that they will continue to dispose non-core assets in H216 and further strengthen its balance sheet. Although the market doesn’t like shrinking production, management is right to shift capital to more efficient assets even that means short-term production decline.

Good management + low cost asset + strong balance sheet + huge growth potential

By the end of 2016, PWE will become a completely different company. Its production will concentrate in Cardium, one of the best light oil assets in Canada. Management has indicated an operating cost per boe of CAD$10-12 (among the best in Canada). Under the oil price of US$45-50, management expect the production to grow 10% annually from 2017. And thanks to the massive accumulated lands, there will be enough space for PWE to grow at least in the next decade. In the meantime, the company is also likely to copy its success in Dodsland to Alberta Viking.

Valuation

Despite a 37% surge on 13 June, the stock price of US$1.26 is still trading at a severe discount to its intrinsic value. The price target of US$3.1 is based on oil price of US$45-50. Cardium asset alone is worth at least US$2 per share after subtracting all the debt. The company’s valuation still looks more like a distressed player while default is not a concern anymore. Eventually, company should trade above its book value of over US$4.