In 2015, the stock price of Iconix (ICON) declined from $34 to ~$6. The whole management team including long-time CEO Neil Cole has been replaced. The company had to restate its financial statements and it is still under SEC investigation for the accounting issue. The market painted a picture of a rogue CEO aggressively taking debts to buyback stocks and dump his shares before leaving the company. Investors began to question whether the whole brand management business is just part of the fraud. The biggest question I had after reading this story is why it took the rogue CEO 23 years to execute the fraud. He must be really patient. After digging deeper into the story, I found it is more complicated. The aggressive use of cheap convertible notes to finance the acquisitions during 2012-13 was the source of the problems. It forced management to buy back shares to counter potential dilution and eventually rig the accounting as things fall apart. There is no question that management did wrong things along the way, but the fear that the whole business is a fraud is also exaggerated at current valuation. With long-time turnaround expert Peter Cuneo in control as CEO, there is still value in this company.

Solid business model but poor capital allocation

Iconix is a brand management company with 35 brands categorized into Women, Men, Home and Entertainment. It licenses those brands to retailers and collects fees based on percentage of product sales. Here is a very brief idea about the business model:

Buying a brand -> Signing licensing contract -> Collecting cash and buy another brand

Almost half of company’s brands were licensed exclusively to one of the big retailers (Walmart, Target, Seas/Kmart, Macy’s or Kohl’s). The business model is actually very sticky. When a retailer has involved and co-invested in a brand for several years, it is unlikely to give the brand away. There are two important things to succeed in this business. First, management needs to find undervalued brands and build long-term relationship with the big retailers. Second, a good capital structure and efficient capital allocation can amplify the return. Neil Cole, as the founder of Iconix and one of the pioneers in the industry, is definitely good at the first. But he failed miserably in the second and almost brought down the company.

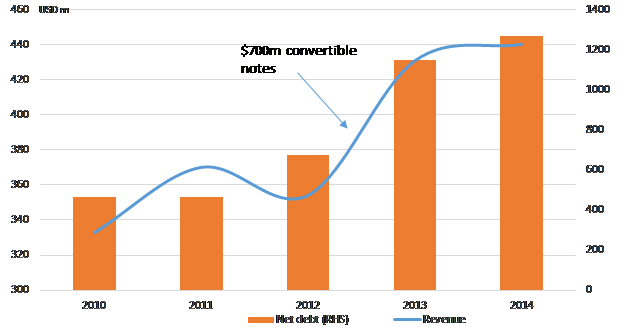

Acquisitions supported by $700m convertible note

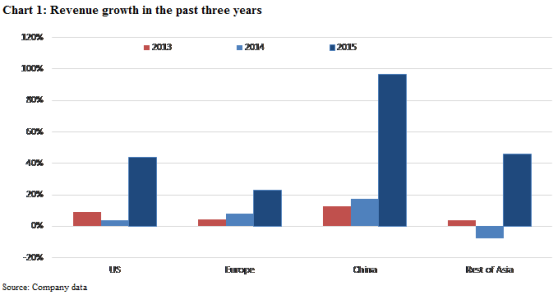

From 2011, management team has frequently talked about cheap financing options like securitization, high yield bond and especially the convertible note in the conference call. The company took $700m note during 2012-13 at cash interest rate of 1.5%-2.5% with convertible options at the price of ~$30 per share. (ICON was trading at around $18 at that time). In my opinion, the pressure to get to $30 stock price was behind the buybacks and the eventual accounting issue. With the huge stock price decline in 2015, the once cheap convertible note becomes an unbearable liquidity problem in 2016. Neil Cole’s strategy to expand globally and enter entertainment segment was a correct move to diversify from the core licensing to US big retailers. He actually built the diversified global presence with the brands like ‘Peanuts’, ‘Strawberry Shortcake’ and ‘Umbro’ in addition to the core US brands. The company now generates ~$400m annual license fee with a ~50% EBITDA margin. But his choice to build it quickly with cheap convertible notes rather than slowly with internal resources has put the company in great danger.

What is left for the equity holder?

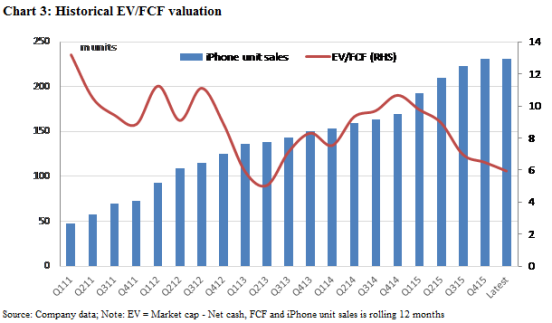

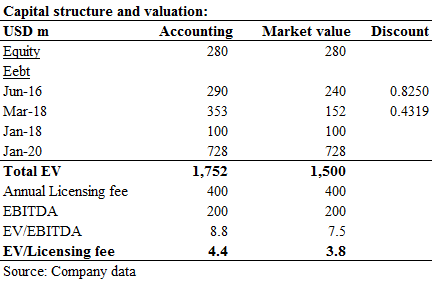

The Iconix stock is currently trading at $5.7 with a market cap of $280m. A valuation based on earnings and FCF does not make sense anymore because of the heavy debt burden. The company was historically traded at 13x EV/EBITDA and 8.5x EV/Licensing fee. Private acquisitions of brands were usually considered reasonable or relatively cheap at 5x licensing revenue. If the company’s brand is still of relatively good quality (which I think is the case), the current valuation can be very attractive considering the track record of the interim CEO Peter Cuneo, a turnaround expert who led Marvel from bankruptcy to $4bn sales to Disney. A sale of the whole company at 5x EV/Licensing fee will generate an 88% return for equity holder.

Moreover, several recent developments have showed that management still has the options to deal with the liquidity problem and the default is not likely. (1) The majority holder of 2016 Convertible Note proposed publicly to refinance the deal with senior secured status, but there has been no response yet from the management team; (2) Two convertible notes due Jun 2016 and Mar 2018 is trading at significant discount to face value which presented buyback opportunity to Iconix; (3) Sports Direct, the original owner of ‘Umbro’ from UK, has bought 14.4% stake in the company in recent months.

Conclusion

After the crash of Iconix’s stock price in 2015 and the ongoing SEC investigation, it is reasonable to be cautious about the business. However, a detailed look at company’s history showed that the crash is more likely to be a failure of financial engineering. With 35 brands generating $400m annual licensing fee and a turnaround expert in control, the Iconix stock is attractive. The eventual solution to the liquidity problem will serve as a catalyst to the stock price.