Download: WDC – Time to be Optimistic (PDF report)

Summary: Western Digital—the leading Hard Disk Drive (HDD) maker—has been feeling the pressure in the past 12 months due to an accelerated decline in PC sales and increased adoption of Solid State Drive (SSD). Last year, the company acquired SanDisk, an SSD maker, to diversify its business. The market thought that Western Digital paid an unjustifiably high price for SanDisk at a time when the competition in the SSD market was heating up due to 3D NAND technology. The company’s stock price declined from $100 to $37. However, this acquisition has the potential to fundamentally change the risk profile of WDC in the impending technology shift. Despite short-term headwinds, the storage market will grow in the long term and Western Digital is best positioned to benefit.

Investment Thesis

- Before acquisition, a dominant player in a declining HDD market

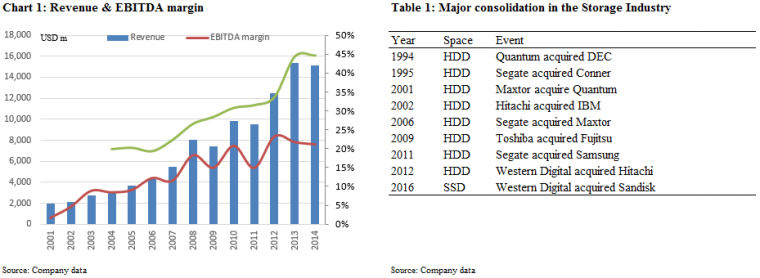

The HDD market came a long way via consolidation to reach the state of trioploy in 2012. Western Digital (43%), Seagate (42%), and Toshiba (15%) have since maintained a balanced market and earned decent returns. During this period, Western Digital achieved a 28%/22% Gross/EBITDA margin and maintained an average ROIC of 14%. However, nothing is static in technology, especially for commoditized hardware. The emergence of SSD has slowly intruded into the HDD market. The development of 3D NAND may further lower the cost of SSD and break the balance in the HDD trioploy.

- An underestimated acquisition that changed the competitive landscape

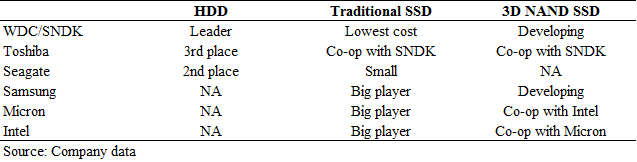

Although the acquisition of SanDisk may appear to be expensive, it completely changed Western Digital’s risk profile. Of the three storage technologies, the new Western Digital’s products are the leaders in HDD and planar SSD. The company is also fighting in the new 3D NAND development. Before the acquisition, there was a risk that the success of 3D NAND would permanently shrink Western Digital’s addressable market. Now, however, Western Digital’s technology portfolio ensures that it can prosper under all scenarios. Moreover, Toshiba’s small share in the HDD market and joint venture with SanDisk will provide it with an incentive to improve its cooperation with Western Digital and this will put pressure on pure players like Seagate.

- Short-term headwinds masked long-term growth potential

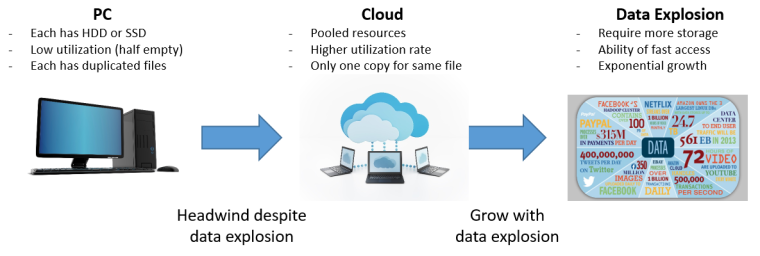

Instead of completely replacing HDD, SSD provides a cost-effective way for certain applications. The future of storage will be a mix of both devices. But it is also incorrect for the bulls to assume that all data will just move to the cloud without any impact on storage demand. Indeed, most of the pain in the HDD market was caused by shifting to the cloud. In the short to medium term during this transition, both the HDD and SSD will be under pressure. But after the transition, storage demand will again match the exponential data growth, and Western Digital is best positioned to capture that growth

Company overview

Western Digital is a hardware maker in the storage segment, mainly HDD, which can be categorized as a commodity despite some differences in the quality and technology. It was very hard for companies to achieve excess returns in the early stages. However, the industry experienced several rounds of consolidation between 2000 and 2012. Currently, three companies controlled 100% of the market, with Western Digital leading at 40%. The company has improved its EBITDA margin from below 5% to constantly over 20%.

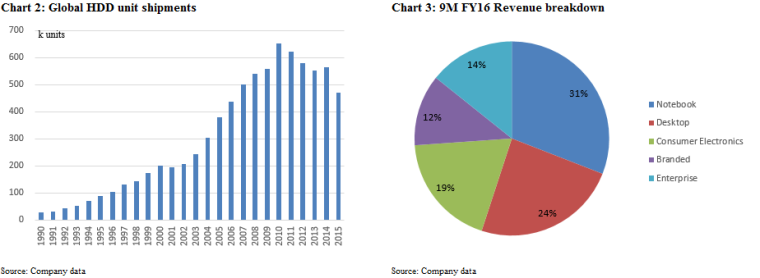

With data growing and the PC market booming, global HDD shipments recorded a 17% CAGR from 1990 to 2010. Since then, overall unit demand has declined due to decreasing PC sales and the emerging SSD. Although three companies still maintain a balanced market and decent returns, accelerated declines in recent quarters and the development of 3D NAND technology have signaled trouble ahead. This is why Western Digital entered into an agreement to purchase SanDisk in 2015.

Underestimated acquisition

What Western Digital paid for its acquisition is clear. The elevated multiple is the most controversial part in the market and the new debt is an additional cost. However, if investors will consider the intangibles that WDC got from the deal, then the overall picture looks different.

Competitive advantage from a diversified technology portfolio

On a standalone basis, the SanDisk acquisition may seem to be unreasonably expensive, but from the industry’s point of view, the combined company will gain a much stronger position. To simplify, the storage business can be classified into three technologies. The HDD has matured and held most of the digital data in the past. It has the lowest cost, but its performance is also relatively slow. The traditional SSD is much faster than HDD, but it is also at least 5x more expensive. The latest technology, the 3D NAND, has the potential to massively lower the cost of SSD and make it competitive with HDD in more applications. However, the characteristics of HDD and SSD ensure that both will be used in the future storage business. The technological issue is now more about mixing and matching the right hardware to a specific application. Below is a summary of the technology portfolios of the major players in the industry.

Technologies portfolio of major industry players:

Before the SanDisk acquisition, investors in WDC worried about the new 3D NAND technology that could replace HDD on a large scale. Actually, it could be a question of survival for WDC. The success of 3D NAND may permanently shrink its addressable market and break the balance of the HDD triopoly. With the acquisition, WDC now has the ability to weather all kinds of scenarios. If 3D NAND turns out to be a huge success, WDC is in a much better position versus Seagate and is more likely to dominate the remaining HDD market. If 3D NAND fails, WDC’s leading position in the HDD and traditional SSD will still help it to succeed in the storage market. Ironically, the WDC stock price was trading at a much higher level when there were huge long-term risks to the company before the acquisition.

Relationship with Toshiba

Another overlooked factor is Toshiba. Its existing SSD joint venture with SanDisk can help to improve cooperation between Toshiba and Western Digital, even in the HDD market. This would put Seagate in a very difficult position. Although Toshiba only has ~20% of the HDD market compared with ~40% each for WDC and Seagate, this dynamic becomes important in a potentially shrinking HDD market. Eventually, there may need to be further consolidation in the industry, and the loser is increasingly likely to be Seagate. Again, ironically, STX was performing much better versus WDC after the acquisition.

Storage demand will grow, but it will take a while

The shift to the cloud has claimed a lot of casualties in both the software and hardware industries. Its impact on the storage segment is a bit complicated. The growth of the underlining data has never been stronger, but the storage manufacturers seem to be suffering. To have a better understanding, we can divide growth into two stages, and the first is the transition to the cloud. During this stage, demand for storage will actually go down. Unlike in the PC era where HDD had a relatively low utilization rate (mine was below 50%), that rate will now increase and less total storage will be needed in the cloud platform. Moreover, instead of having 100 of the same files on 100 PCs, now you need only one in the cloud. At this stage, the main theme is to improve the efficiency of storage systems. However, there is a limit to this efficiency. This brings us to the second stage where storage demand will eventually catch up with the data growth.

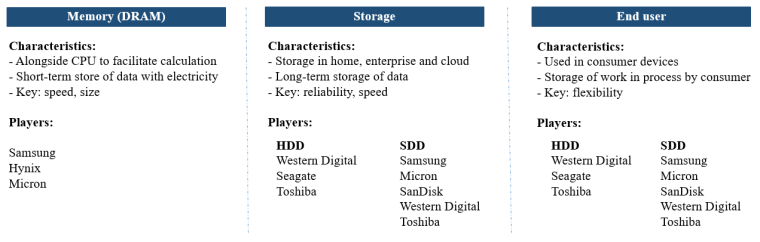

The acquisition has put Western Digital in a very comfortable position to benefit from the long-term data growth. We can divide the storage market in a different way: 1) DRAM, the memory that works alongside CPU to facilitate fast calculations, 2) end users, traditionally PC and now also those mobile devices, and 3) storage, the major devices that store most of the data for the long-term. Below is a summary of the segments and the players.

Different industry classification:

Source: Company data

DRAM and end-user segments are actually not highly correlated with the long term data growth. DRAM is more about improving the performance with the CPU. With the trend of cloud architecture, less data is stored on the user end. The task of storing future data will fall to the middle part with the usage of both HDD and SSD. Western Digital, after the acquisition, is best positioned to capture the long-term growth in this segment.

Valuation

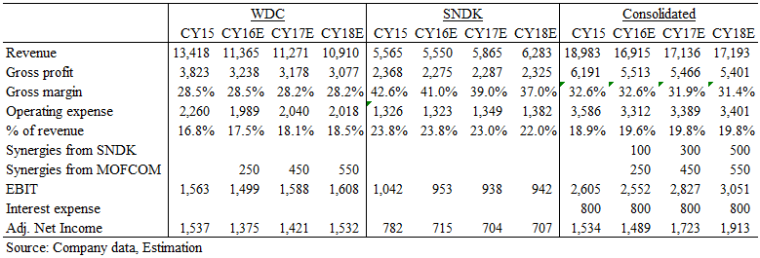

Western Digital announced the closure of SanDisk acquisition on May 12. On the pro forma basis, with conservatively estimated synergies from both SNDK and MOFCOM, Western Digital can achieve adjusted earnings of around $1.9bn in CY2018. 18-month price target of $68 with implied P/E of 10x. Current market price is suggesting that there won’t be any synergies.

Despite recent headwinds, the storage market is still a solid industry in the long term with limited players. The acquisition of SanDisk gave Western Digital more competitive advantage over its peers with an attractive technology portfolio. Although the growth will take some time to materialize, the depressed valuation is not justified and provides opportunity investors.