Store Capital is a Real Estate Investment Trust (REIT) focusing on Single Tenant Net Lease market. The company was initially sponsored by Oaktree Capital (already exited after IPO) and recently got a lot of attention after Berkshire’s 10% investment. Single Tenant Net Lease market, despite being very liquid for a long time, is very inefficient in pricing individual stores. Store Capital claims that it is using a different way to explore those mispricing. The theory sounds promising but there needs to be more long-term data to validate that. A lower valuation close to its property acquisition cost ($20/share) will provide more margin of safety.

What is Single Tenant Net Lease

In the Single Tenant Net Lease market, investors buy free stand property and lease it to a single operator with the tenant covering taxes, insurance and maintenance. The type of property includes drug store, convenience store, dollar store, auto service, healthcare, quick service restaurant and any single operator property. Total size for the market is at least $2tn in US. Most of those lease contracts are long-term with initial period of 15+ years and several optional periods. The long-term lease contracts in a lot of cases are superior to the corporate debt in the restructuring. Depends on different types of tenant, investors usually get an annual rent increase of 1%-2%. National/regional brokers and exchanges exist for investors to trade in a liquid market. You would think that there should not be huge mispricing. But it is not the case.

Mispricing in the market

Cap rate is the mostly used valuation method to compare real estates. Investors use tenant credit, remaining term and other factors to determine a cap rate. For properties like residential, office and multi-tenant shopping malls, that make sense because those properties have a general purpose and their functions are the similar to a large group of potential tenants. However, that cannot be said about Single Tenant Net Lease. A movie theater and a car service center can only be used that way unless you invest a huge amount of money to rebuild it. Thus, the most important thing in valuing a Single Tenant property is to find out how long can that business continue without major investment (rebuild). However, the market is not valuing properties that way.

- Same Tenant but Different Quality

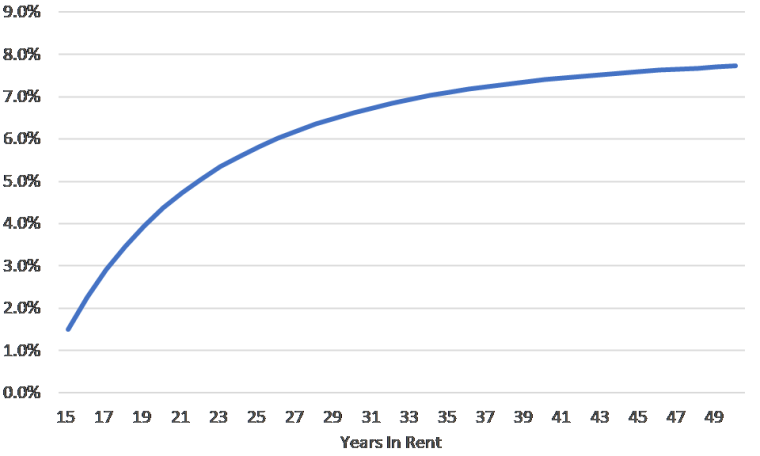

If we think about two similar Dollar Generals with same rent and contract (initial term of 15 years and 5 optional 5-year terms). Mostly likely they are priced at the similar cap rate and price. Considering that most of the new Dollar General expansions are in small towns severing limited number of local people (Kind of in the middle of nowhere), Dollar General is very likely and easily to twist its store format and relocate to a new property in the same area. I doubt there will be a lot of value left in the old property. Assuming the extreme case that the value of property eventually goes to zero, IRR can be in a wide range of 1% to 8% depends on when Dollar General get out of the contract. Yet, the two properties are likely traded at the similar price.

Chart: Unleveraged IRR for soon the building’s value goes to zero

Source: Estimation

- Rated vs. Not rated

Another mispricing result from too much emphasis on tenant credit rating. Although there are some exceptions, a higher credit rating usually results in a lower cap rate (higher property price). However, the tenant only guarantees the rent payment in the period of ~15 years. Unlike a bond that also guarantees the principle payment, the terminal value of a property totally depends on the performance of that single store, not the corporate tenant that can leave. Yet again, market is valuing creditworthy properties closer to tenant’s debt. On the other hand, properties of smaller operators have a higher cap rate even their performance are the same or even better on a single store basis.

- Different business in the Single Tenant space

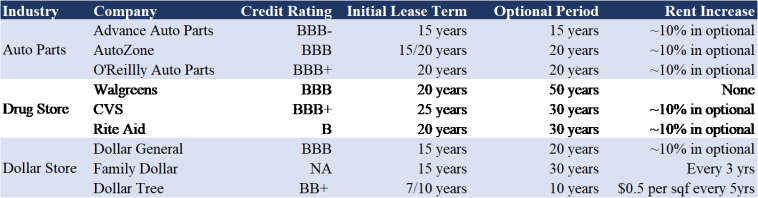

The last mispricing is even harder to quantify. Investors can easily compare the IRR of different offices, apartments and even malls with indicators. But in the Single Tenant market, how do they compare AMC vs. Dollar General or Advanced Auto Parts vs. KFC. It seems to me the business of Single-Tenant property is more about business analysis than property analysis. True value depends on how well the operators run the businesses and how likely they are going to move. Below is a list of lease contract comparison for major operators.

Table: Comparison of lease contract

Source: Exchange Market

The Store Capital Way

After discussing all the mispricing in the market, here comes the Store Capital. The company is created by its experienced management team (supported by Oaktree) to explore those mispricing opportunities.

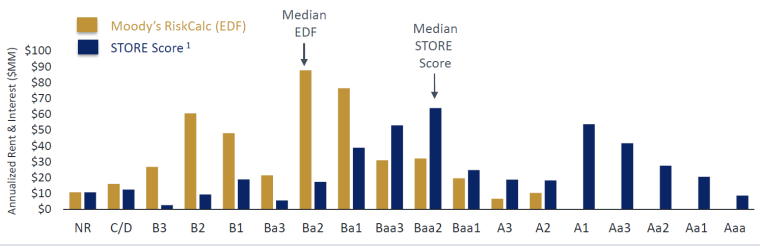

- New Credit Rating System

Unlike other REITs in the segment, Store Capital clearly identified that value lies mostly in the single store level rather than corporate tenant rating. The management uses its experience and data to create its own way of ranking single store. Theoretically, the difference between Store’s ranking and market’s credit rating is the potential value creation over the long-term.

Chart: Store Capital Assessment of Credit vs. Market

Source: Company

- Concerns about track record and capital allocation

Theoretically, I believe that the mispricing exists on a large scale in the Single Tenant Net Lease market and Store Capital has articulated a very interesting way to profit from it. Fundamentally, the business depends on the management being good investors figuring out which business and operator will last long enough to generate superior return. However, it is extremely hard to prove that the properties STOR bought are different. And there are several concerns around the company.

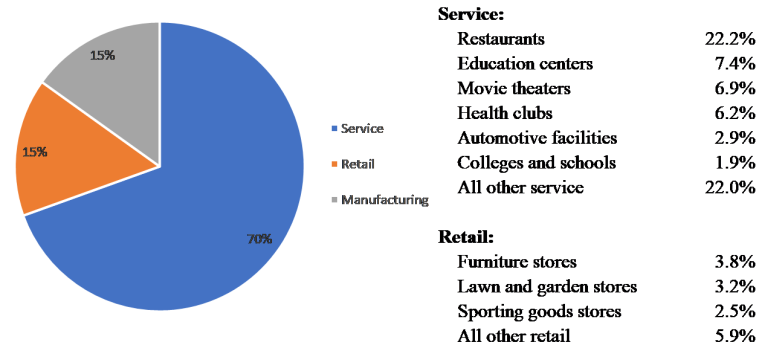

Track Record: It is true that the management has been in this industry for a long time and they are clearly articulating a different way of doing business. Store’s system led it to find more on operators like movie theater, education center and the type of properties that are unique and hard to be used other ways. While it gives those business a unique advantage in the local competition, it also increases the risk of re-tenant.

Chart: 2016 Store Capital rent breakdown by tenant industry

Source: Company

Capital Allocation: Having Berkshire as an investor is truly a vote of confidence in the company. However, selling shares to Berkshire at the valuation of less than 1.1x historical cost does not appear to be a prudent capital allocation if management believes they have bought undervalued assets.

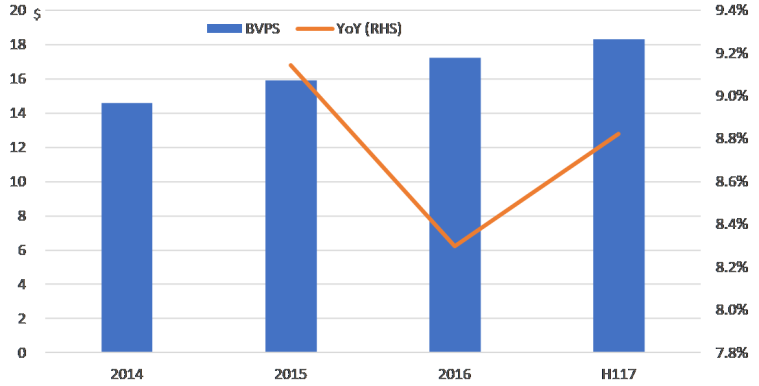

Chart: Book Value Per Share and YoY growth

Source: Company

Valuation

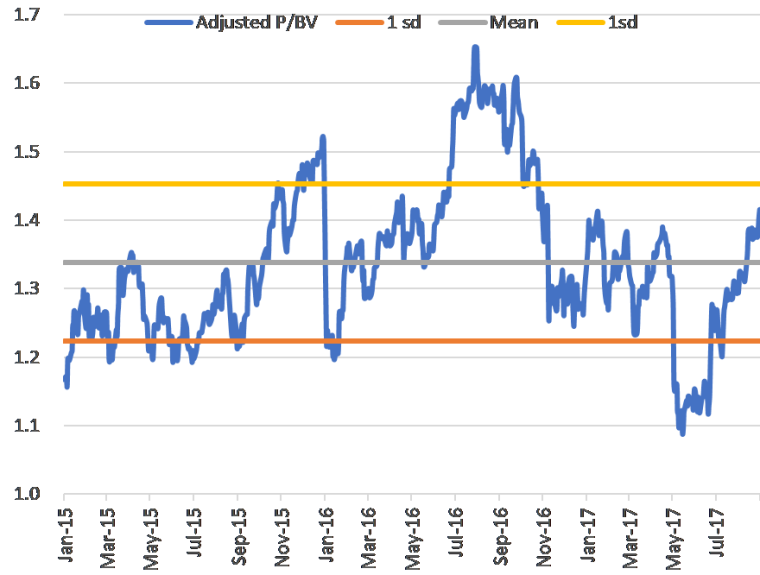

The true value of the REIT is always the value of the properties in its portfolio. The balance sheet recorded historical cost and the accumulated depreciation. Real depreciation is tricky because it depends on how long the cash flow can come in before the investment goes to zero. Considering that the young age of Store’s portfolio, we can track its market cap vs. the historical cost of properties. A valuation of close to 1x will provide margin of safety.

Chart: Adjusted Price to Book Value over time

Source: Company

- Real Estate value + rating system

There is another interesting way to look at the value of Store Capital. The company is a combination of two parts. One is the traditional real estate portfolio. The other is the unique rating systems they are trying to build. In case the system really works in the long-term as the management claims, there is a potential to even separate it into a pure rating company to serve the vast Single Tenant market. It is extremely difficult to execute with so many moving parts to determine whether a business is long-lasting. But who says a rating agency need to be right all the time.