This is a revisit to a short pitch in a group stock pitch competition last year. Although I do not think this company is a convincing short at current level, it is still an interesting case to look at. Buffett once said: ‘When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.’ It is the case most of the time, but good business is not a guarantee to success. Sometimes a poor management team can gradually destroy company’s competitive advantage and shareholder’s value. Houghton Mifflin Harcout (HMHC) has the potential to become one. It is a dominant player in the growing K-12 education content market. However, during the transition to digital, management has been mainly focused on maximizing short-term result and failed to invest for the future, especially in the technology platform. With a confusing accounting practice, market is valuing the company based on a peak earnings in a volatile industry. The unrealistic expectation has setup the company for disappointment in both the short-term and the long-term.

Solid business but poor return

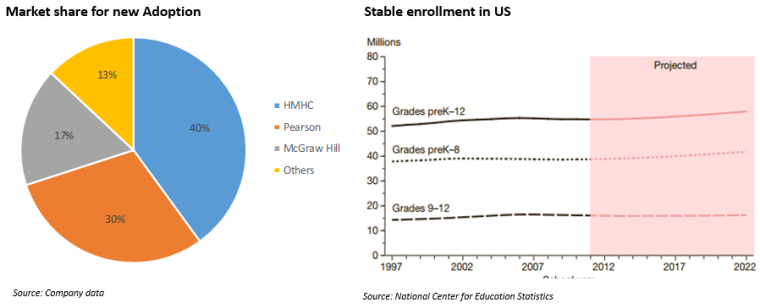

HMHC’s main business is selling educational content to K-12 schools. The selling process is very complicated and it normally takes over two years to close a deal. The company needs to get approval from State Committees, Legislature and Districts for the solution to win a state contract. However, this also provides significant barriers to entry for this industry. Three companies collectively control around 90% of the market share and HMHC is the leading player with an attractive margin. Although the business is very volatile on a YoY basis due to its dependence on state budget, long-term demand is very stable and highly correlated to the enrollment.

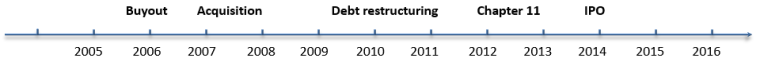

Despite having an attractive business to operate, HMHC did not generate exciting returns in the past and even went into bankruptcy. The company was a target of a leveraged buyout in 2006 and it did several bolt-on acquisitions in 2007. From 2008, the financial crisis started to put a huge pressure on state budget. The lower demand, high interest burden and poor execution led company into troubles. The debt was restructured several times from 2009 to 2011. The company finally went into bankruptcy in 2012 with most of the debt holders changing to shareholders.

The company replaced the whole management team in 2011. The new CEO was from Microsoft and had a great resume. The company went public again in 2013. From investors’ point of view, the stock can be really attractive with good management and a solid business. However, in the past two years, there were signs that management still focused too much on short-term performance and under-invested for the future. Short-term FCF has been maximized and new debt has been issued to support buyback. Management’s compensations through option are highly aligned with the old debt holders who will likely exit in the near future.

Confusing accounting, valuing company based on peak earnings

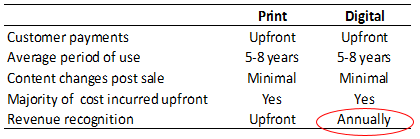

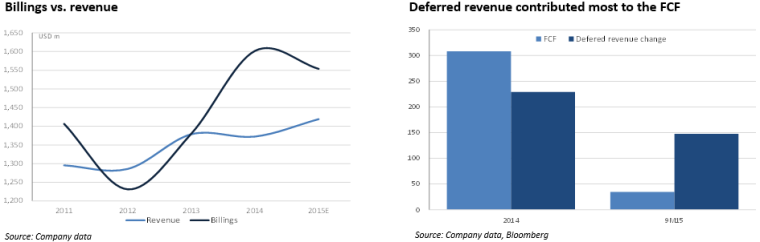

Contrary to its competitors like Pearson, HMHC seems to be very complicated for investors to analyze. There are two differences in accounting that contributed to the complexity. First, the company decided to use accelerated amortization on its revalued publishing rights during the chapter 11. Although there are tax benefits for the accounting treatment in the early years for HMHC, it is not sustainable and FCF is overstated in early years. Second, HMHC is in a transition from selling print content to selling digital content. Although the underlining business models are completely the same, the accounting treatment on revenue is different. This resulted in a much faster growth in billings, deferred revenue and FCF.

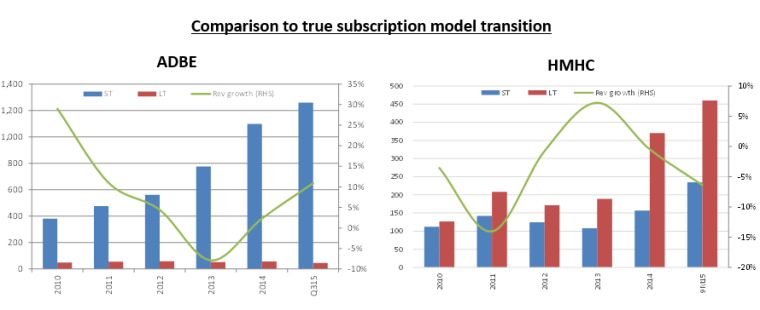

The confusion led some analysts to believe that HMHC is transforming into a different business model and the cash flow can be more sustainable. Comparing HMHC to some truly successful transition like ADBE, the same increase in billings and deferred revenue are telling completely different stories. While an increase in short-term deferred revenue is a good indication that the customers will continue to pay subscription cash next year without more efforts, an increase in long-term deferred revenue in HMHC’s case is basically saying that the company won’t get any cash from that specific customers for at least 5 years. Despite all the confusion in the accounting changes, HMHC’s underlining business and cash flow pattern is still the same. The long-term demand for educational content may be stable, but HMHC’s cash flow is not recurring and it has to compete for every new contract.

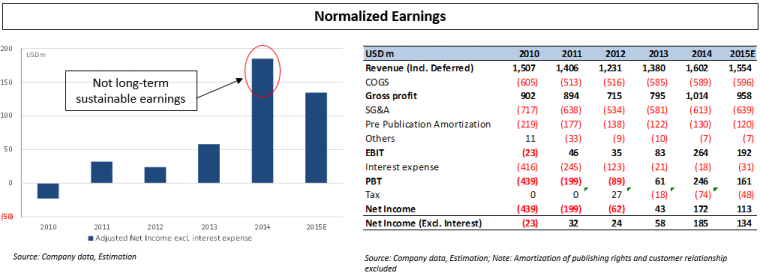

To find normalized earnings for HMHC in the long term, we need to adjust the reported numbers by taking out the amortization of publishing rights and adding back the deferred revenue into reported revenue. From normalized earnings, we can clearly see the short-term cycle in the business. From 2010 to 2013, the pressure from state budget kept the new adoption low. There was a pent-up demand release in 2014 mainly from the mass adoption in Texas and California but it cannot be sustained. However, management is implicitly calling a transition to a more stable business model and continued growth from 2014 level. Investors should definitely not value the company based on the cycle peak cash flow.

Maximizing short-term FCF while sacrificing long-term potential growth

While it is concerning that market is potentially valuing the company at cycle peak cash flow because of the accounting confusion, the solid business should provide long-term support. However, management’s recent strategies have raised the alarm for the long term investors.

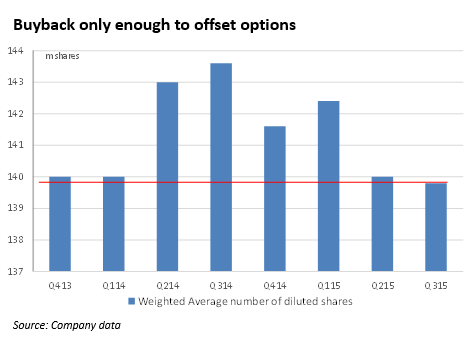

- Issue debt to support buyback

It is interesting that the management started to take debt to buy back stock only 2 years after IPO (5 years after chapter 11). Sometimes it is good for the company to add some leverage and enhance return. But excessive debt clearly does not work in HMHC’s industry. It was worse to buy back stock at cycle peak earnings and only enough to offset the options granted. But all this became reasonable when investors realize that previous debt holders granted management huge options during the bankruptcy period and the vesting period of those options was highly aligned with debt holders exiting time frame which is 2015/16.

- Using third party technology platform

There is no doubt the educational content market is undergoing a fundamental change to digital platform and HMHC is still the market leader initially. But both HMHC and Pearson chose to license the technology platform from Knewton while McGraw-Hill purchased a proprietary technology to develop its own platform. In my opinion, HMHC’s management has underestimated the importance of investing in technology during this critical period. I think the recent change to digital content is just the first step in the transition. In the future, not only the content will be changed to digital, the whole business model will change dramatically as well. Although the third party provider can help HMHC save a lot of money and boost short-term FCF, it runs the risk of losing control in the interactive education and eventually become a mere content provider.

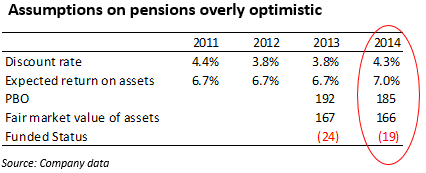

- Squeezing the assumptions

On top of the buyback and technology platform choice, management’s assumption on pension also raised questions. Management increased discount rate from 3.8% to 4.3% in 2014 and expected return on assets from 6.7% to 7%. Adjusting the pension and new borrowings, the Liability to Asset ratio increased to 66%.

Conclusion

The biggest problem for investors to value HMHC is that there is no comparable company available in the market and the confusion in accounting clearly make the job harder. But after normalizing the earnings, we can see that the stock is currently trading at ~13x P/E on 2014 cycle peak earnings. The stock price has jumped from $12 at IPO to $27 last year but has since fall back to $19 level. I believe that the market will continue to realize the real earnings power as company fail to generate stable FCF. And in the long-term, management’s strategy to under invest will gradually erode company’s competitive advantage.