Download PDF report here: spd-stock-idea

Summary

Sports Direct (SPD) is the leading UK sports retailer with more than 50% market share. In the past year, almost everything went against the company and its stock price declined 63% in USD terms. Despite being probably one of the most hated companies in UK recently, SPD still has a solid balance sheet and a valid value proposition for customers. More importantly, most of the problems that caused the decline in valuation in the past year were either temporary or solvable. The depressed valuation of 1.2x P/B is not justified and presents an attractive investment opportunity as a contrarian play.

Investment Thesis

- One of the most hated company in UK recently

Nowadays in the UK, it is hard to not notice the negative media coverage about SPD and its founder, Michael Ashley (owns 55%). To some people, SPD is almost identical to pure evil because of its labor practices. Investors hate it for other reasons as well. After decades of fast growth in the UK, its strategy of pushing its own brands started to backfire. Acquisitions in other European countries and Premium Life Style stores failed to meet expectations. Short-term impacts from weather, consumer trends, and GBP depreciation will add further pressure. EPS is expected to decline ~30% in the next year. Furthermore, the company’s plan to potentially increase investments in UK properties has clearly frightened investors.

- Solid balance sheet and problems are solvable

In retail, a company’s income statement can be affected easily by a pricing/product strategy and other short-term factors over several years. But in the long term, the quality of the assets, the brand, and the value proposition to consumers still determine the intrinsic value. Opportunity can emerge as investors focus too much on income statements. In SPD’s case, the company has a strong balance sheet to weather the short-term fluctuations. The overall sport segment is probably the only healthy part in the retail sector now. SPD may overreached in promoting its own brand to increase margins. But this damage is not irreversible and management is doing the right things to repair relationships with third-party brands like Nike.

- Corporate governance is an issue but capital allocation is efficient

Like other founder-owned companies, SPD’s corporate governance and capital allocation seem to be an outlier among public companies. Michael Ashley has made most of the decisions since he founded SPD in 1982. The company operated without a CFO for a while after going public. It bought a >10% stake in one of its listed UK competitors in 2008. It was actively trading similar retail/brand companies like DKS and ICON during market downturns. It recently announced a tender offer like buyback for 5% of its own stock. No matter how crazy those capital allocations may seem, the result speaks for itself. Well, at least it is better than a buyback at any price.

Valuation

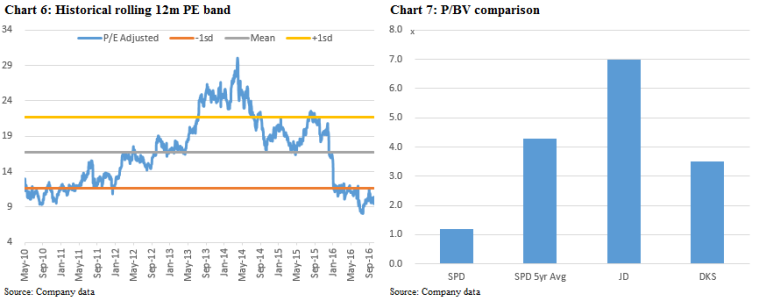

The SPD stock price has dropped 64% in the past year and implies a valuation of ~12x depressed 2017 earnings and more importantly 1.2x P/B. PT of 4.63 is based on 2x P/B representing a gradual recover from trough 2017.

Company overview

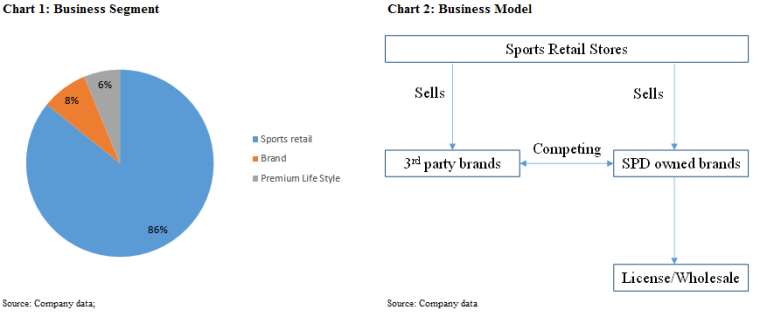

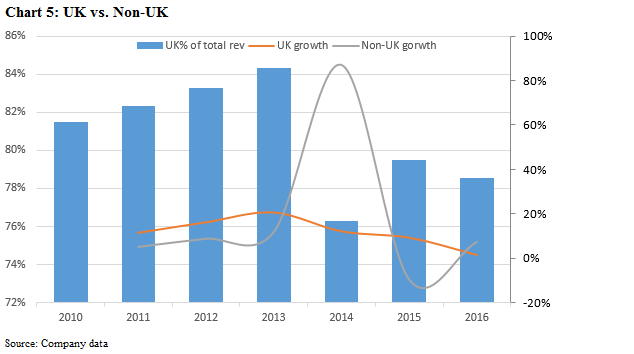

Michael Ashley founded Sports Direct in 1982 and built it from a single store to dominance in the UK market in the following decades. Nowadays, the business consists of three segments: Sports Retail, Brands, and Premium Life Style. Although a lot of factors have contributed to SPD’s success in the UK market, its use of its own brand has clearly differentiated the company. We know that large retailers use private labels to lower their products’ prices and increase their margin. SPD; on the other hand, some acquire a large portfolio of well-known UK brands. The brand segment not only provided additional profit to the company, it also gave SPD the leverage when dealing with the 3rd parties like Nike and Adidas. In other European countries, SPD has built its business mainly through acquisitions, but it is still small relative to its competitors like Decathlon.

Core problem is the strategy and it is solvable

Despite having many problems like labor or Brexit in the headlines, there are two core issues that have driven down SPD’s growth and earnings: the backfiring of its strategy to promote its own brands and its failure to grow in other European countries.

Balance between 3rd parties and own brands

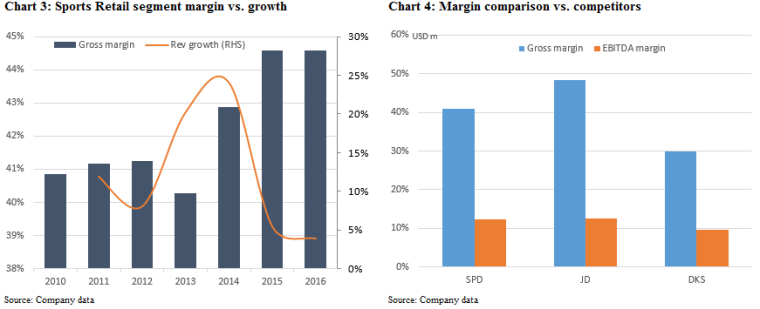

The combination of the largest retail assets in the UK and its own brand-filled portfolio gave management a lot of leverage. Its strategy is to always promote its own branded products, which generate higher margins. Even this practice hurts its relationships with third parties like Nike and Adidas. SPD’s dominant position in the number of stores guarantees that third parties cannot ignore it. However, there is a limit to how far SPD can push. For several years, margins have been increasing, but the third parties have started to respond by sending their latest products to SPD’s competitors.

In FY16, like-for-like sales growth at SPD declined to -0.7% from ~10% in the past five years, while its competitors were still enjoying healthy growth. FY17 is expected to be a tough year for SPD. However, management has recognized the problems and started to change. Previous targets of growing margins have been changed to repairing relationship with the third parties. Although it will take time for SPD to execute these changes and its earnings will be depressed in the short term, the strong asset base (stores and brands) makes the turnaround more likely.

Growth in other European markets

Before 2015, SPD was always regarded as the dominant sports retailer in UK with huge potential to grow in other European markets. Its stock was traded at a large premium because of this potential. However, the growth has disappointed, despite several acquisitions. In my opinion, one big advantage that SPD has in the UK is its brand portfolio. But those brands are mostly well known only in the UK. Moreover, there have already been several competitors with considerable market share. In my opinion, it is not reasonable to assume that SPD can copy its business model in continental Europe. But with the decline of its stock price and its expectations, the future returns will mainly depend on the UK market.

Negative sentiment exaggerated

Besides the two abovementioned fundamental issues, many other problems have contributed to the significant stock price decline in the past year. Those problems, with extensive media coverage, have enhanced the negative sentiment and created a perfect storm. They may have a huge impact on SPD’s short-term earnings and stock price, but they will not permanently damage the company’s long term earnings power.

Labor: Nowadays, it is hard to not notice the negative coverage of SPD’s labor practices. Some people think the company is pure evil and customers are organizing boycotts of its stores. There is no doubt that the company’s practices are not right. The customers’ reactions and one-time compensation/fines will depress short-term earnings. But purely from a financial perspective, the potential increase in long-term labor costs will not be unbearable. Investors can look at the case of Nike’s labor practice issue for comparison.

Macro: After the Brexit vote, the GBP depreciated sharply and SPD was caught off guard with no hedge in currency. The company is expected to take a hit in FY17, but this won’t be a recurring issue. In terms of Brexit, it is a huge risk and uncertainty to all the companies in the UK. After the vote, investors may assume that the British people will do whatever it takes to destroy their own economy, but at least that has already been priced in.

Corporate governance: For founder owned companies like SPD, corporate governance is always an issue. The company operated without CFO for a while after being public. It bought a >10% stake in one of its listed UK competitors in 2008. It was actively trading similar retail/brand companies like DKS and ICON during market downturns. It announced a tender-offer like buyback recently for 5% of its own stock. No matter how crazy those capital allocations may seem to be, the result speaks for itself. Well, at least it is better than those ‘buyback at any price’.

Valuation and comps

SPD is currently trading at ~12x FY17 earnings (vs. 5yr average of 16.7x) and 1.2x P/BV (vs. 5yr average of 4.3x). The company’s short-term earnings is depressed because of a combination of several problems mentioned above. However, the long-term earnings power is much higher vs. current level. PT of GBP4.63 (2x P/BV) in 12-18 month as company fix its UK strategy problem and negative sentiment gradually ease.