Summary

TAKKT AG is a Germany-based B2B direct marketing retailer. It helps business customers to purchase specialized equipment for plants, warehouses, offices and food chains from over 1,000 suppliers. It facilitates the purchases by providing catalogs, online marketing, logistics, procurement and advice. Since its IPO in 1999, the stock has consistently outperformed the index and its peers’ because of efficient capital allocation and carefully maintained economic moat. Current valuation of 14x 2014 P/E provided an attractive entry point for investors to enjoy long term value creation.

Investment Thesis

- 15 years’ track record of efficient capital allocation; ROE stable at ~20%

Since 1999, TAKKT has engaged in 6 acquisitions, 3 divestments and 1 stock buyback. Management followed a strict rule in the acquisitions targeting above 20% equity return under conservative assumptions. It also treated buyback as an investment decision under the same rules. In Feb 2009, company conducted a tender offer to buy back 10% of total shares at a very attractive price. Moreover, TAKKT made 3 divestment to shed low return businesses, and a cumulative dividend has amounted to above 80% of IPO price.

- Strong economic moat with high margin

TAKKT operated at a higher margin than its competitors and the margin difference was widening after the financial crisis in 2008. That was mainly caused by: (1) Economic of scale and diversification that provided cost advantage; (2) High value proposition to customers from recommendation to customers using accumulated knowledge; (3) Focus on building a portfolio of leaders in niche market. Moreover, TAKKT also enjoyed an extremely fragmented suppliers and customers. Considering the high initial investment to build logistics and acquire suppliers/customers, the high margin is well protected. - Market priced different earnings and management quality at same multiple

Takkt and its major competitor Manutan is trading at a similar level of 14x 2014 PE. While there is no discount on multiple, the earnings quality of Takkt is much better because they were derived from high margin business with protection from economic moat. And the management team in Takkt showed superior ability in capital allocation to create value for the past 15 years. Market failed to reflect the long term predictability of earnings by focusing too much on short-term performance. - Valuation

In past 15 years, TAKKT stock generated a CAGR of 10% without multiple expansion. A stable management with its strict focus on return is likely to maintain a 20% ROE. Current valuation of 14x 2014 PE is attractive for investors to enjoy the long term compound return from efficient capital allocation and an improved business portfolio. Potential return can be in a range of 10%-18% CAGR in 5-10 years.

Company Overview

TAKKT AG is a Germany-based B2B direct marketing retailer. The company is operated under decentralized corporate structure with Group Company making capital allocation decision and regional company with its own brand making operating decision.

Chart 1: Company structure

Source: Company data

TAKKT built its business portfolio in diversified sectors across US and Europe. Revenue from Europe accounted for just above 50% of total revenue while profit from Europe stood at 70%.

Chart 2: Diversification of regions and product ranges

Source: Company data

In terms of the management, Takkt had a very stable team and well managed transition history. From 1999 to 2009, Georg Gayer was the CEO of the company and Felix A. Zimmermann was CFO. They made most of the capital allocation decisions during that period. Felix A. Zimmermann, now 47, became CEO in 2009 after Georg Gayer’s retirement. Since then, there was no change the way the company made capital allocation. In the company’s Board, most of the members came from Takkt’s controlling shareholder Franz Haniel & Cie. GmbH (50.2% of total shares).

15 years’ outperform without multiple expansion

Since Takkt’s IPO from 1999, it has achieved CAGR of 10% in the past 15 years. The stock return was slightly better than DAX and S&P500 while significantly outperformed its peers in the industry both from US and Europe. Moreover, it is currently trading at 14x PE, same as it was in 1999. The consistent outperform was not a coincidence or deviation from mean but rather a result from carefully managed economic moat and disciplined capital allocation.

Sustainable economic moat

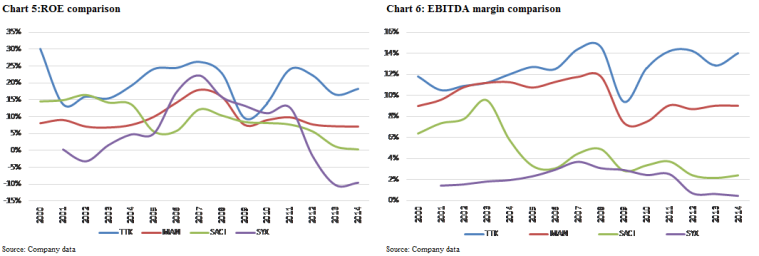

B2B marketing for equipment is a very competitive market with several big listed companies but more regional small private players. However, Takkt has consistently achieved the highest margin and ROE in the industry.

- Value proposition & competitive advantage

Consistent higher margin is obviously a good thing for the company. But a more important question is where is the higher margin coming from and whether it will be sustainable. In Takkt’s case, the difference in margin can be explained mainly by gross margin difference which reflected higher value proposition to customers. Higher customer value comes from several areas: (1) A wide range of products to choose from, (2) Recommendation from Takkt on the quality of product from past experience, (3) Customized solutions to meet customers’ unique demand, (4) Longer warranty periods, and (5) Faster and flexible delivery. All those advantages were supported by some kind of moat that protect competitors from competing away high margins.

Because Takkt is the biggest operator in all its subsectors, it can provide a one-stop shop for certain industries. With the accumulation of past user experience, Takkt is in the best position to help customers on purchasing. The shared logistic services and IT systems further enhance the competitive advantage because Takkt as a whole is the biggest company in the industry. (3-times the size of the second company by market cap).

- Sustainable moat with high margin

Although the direct marketing business is a very competitive industry, Takkt’s management and strategy has done a great job of keeping its advantage for a long time. Part of the reason is it is hard for companies in different subsectors to compete out of their original businesses. The initial investment to build relationship with fragmented suppliers and customers was very high. And considering Takkt’s deliberately picking of industries with ~5% organic growth, it is not attractive for new companies to enter the market.

Another critical part to protect the moat is management’s philosophy on capital allocation. Company has strictly followed the rules to acquire successful operators in the niche market. And it targets to get different knowledge on customers or industry from the acquisitions. Through this, Takkt is consistently looking to widen its moat and ensure that it can earn an excess margin and return.

Capital allocation

Since 1999, TAKKT has engaged in 6 acquisitions, 3 divestments and 1 stock buyback. Management followed a strict rule in the acquisitions targeting above 20% equity return under conservative assumptions.

Table 2. Historical capital allocation decisions

- Acquisition; TAKKT’s acquisitions usually included below terms: (1) Successful leader in a niche market; (2) Previous owners continued to run the department independently while infrastructures like logistics and order systems were consolidated; (3) Additional knowledge of new market or leading ways of marketing can be learned and applied to more groups; (4) Valuation of ~10x P/E with high EBITDA margin

- Divestment; All 3 divestments from Takkt in the past decade were to sell its legacy businesses that have a permanently lower margin prospect and growth potential. During the divestment process, resources were freed for management to make additional acquisition. But the resulted slow revenue growth masked true growth potential of the company.

- Buyback; Takkt treated buyback activity correctly as a reinvestment decision. Rather than making open-ended buyback commitment, Takkt preferred to use tender offer to buyback stocks at attractive price. In Feb 2009, the company bought 10% of shares using tender offer at the price of EUR7.9. The decision also contributed to long term outperform comparing to competitors’ buying not-that-good businesses to support revenue at the same period.

- Dividend; Takkt also promptly returned cash to shareholder when there were no attractive investment opportunities in 2007, 2008 and 2011. The management showed a strong track record of capital allocation. Investment in Takkt can be partly seen as a delegation of investing decisions in the direct marketing area targeting 20% ROE. Management is very predictable and this provided solid protection for the downside.

- Outlook; Management will continue to execute similar strategies in the future. With all divestments of legacy businesses finished in 2015, organic growth of 5% can be expected in the long run. Further growth can be realized from acquisitions. Considering the natural of the industry where a lot of small successful family owned companies dominated individual niche markets, there will be ample opportunities for Takkt to invest.

Valuation & Comps

In the past 15 years, TAKKT stock generated a CAGR of 10%, in line with book value growth. Current valuation of 14x 2014 PE is attractive for investors to enjoy the long term compound return from efficient capital allocation and an improved business portfolio. Possible CAGR can be at least 10% in the next 5 to 10 years.

In addition, below is a DCF valuation table based on 8.3% WACC and 2% terminal growth rate for reference.