Summary: In recent months, the equity market crash in China has become a hot topic, but there are more serious problems and trends in the underlining economy that merit a closer look. In the near term, the declining interest rate difference, depreciation of the currency, and legacy overcapacity have started to squeeze the carry trades that provided a substantial part of the local monetary base. This will lead to a death spiral of shrinking money supply despite the central bank’s easing. But the fundamental problem that caused the recent turmoil is a shockingly low return on investments in China. In the long run, the inevitable rebalancing that the market is looking for is essentially a resetting of the rate. This will have a significant impact on the global market and the prices of exports from China.

Death spiral in action

In my previous Macro Comment in May 2015, I mentioned that there exists a large group of carry traders who borrow in U.S. dollars and invest in the wealth management products in China (implicitly guaranteed by the government). This has become a substantial part of the domestic money supply. At that time, the worry was that an easy monetary policy in China and a potential rate hike in the United States would squeeze this group of investors and create a death spiral. Looks like the process is now under way. The rate difference between USD and CNY continued to decline to around 2.5% from 4% in early 2015. Trade data discrepancies reported by China and Hong Kong have narrowed sharply, indicating that less money flew into China using fake trades. A one-time 3% depreciation in the CNY was a shock to the assumption of a stable currency, making it become harder to refinance, as more and more bad projects were exposed. All of these factors were pushing the carry traders to wind down their investments, which put additional pressure on the currency. As China prepares for more easing and the United States is getting closer to a rate hike, investors can expect the death spiral to reinforce itself and create more headlines from China.

Long-term implications from rebalancing

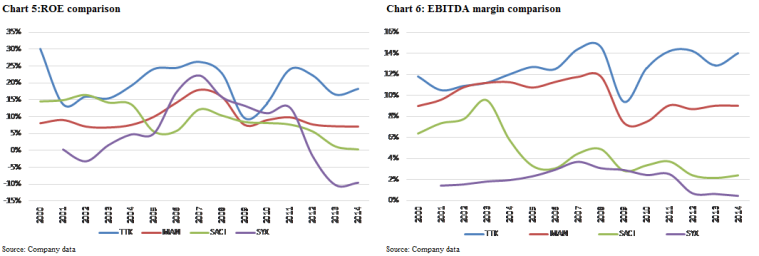

Although the recent short-term volatility in China may have had a negative impact on the global market, it is the shockingly low return on investments across all asset classes in China and their inevitable rebalancing that will have a larger long-term impact.

- Shockingly low returns across all asset classes

Analyzing China always seems to be difficult because of the data problems and government policies. But if you think of China as a “company” and its exports as products, then China will be much easier to understand. Since 2000, this “company” had been very successful because of its low cost advantage and high return on investment. Shareholders were attracted and put in more money. But as the “company” grew, it invested all its profits in new capacities and this resulted in a massive oversupply. In the meantime, cost had become a problem. Housing prices, labor costs, and an inefficient public sector were the biggest contributors to the cost increases.

The result was a disastrous return on investment of close to zero, if not negative. Housing prices have tripled since 2009, and the annual rental yield has declined to below 2%. Massive investments in infrastructure, partially supported by the carry trades, were made without profits or even cash flows in sight. Exporters, squeezed by the rising currency, labor costs, and hidden taxes, are now on life support from government subsidies and one-time asset transection gains. Part of the reason for money to leave China is that it is really hard to find investments with reasonable returns.

- Rebalancing is simple in theory but hard to execute

Just like the restructuring of a company in a similar situation, the solution is actually simple. The resetting of the return will involve cutting the capacities and costs and eventually raising the prices. But the execution is hard, especially in China. The labor cost is constantly rising because of the one-child policy, and this will be difficult to change, even in the long run. This leaves the burden of cutting on two entities: government and housing. Both are hard to cut and doing so will result in a direct hit to the banking system. Finally, there is another ugly way to reset the return, which is the depreciation of the currency to bring the prices back into line with the costs. The whole rebalancing seems to be an impossible mission, but it is inevitable as the current system cannot be sustained. And the recent market turmoil suggests that the tipping point is coming closer.

- Implications to the global economy and market

Although predictions of timing and paths involve many uncertainties, several things are very likely to happen. During the process, we should see a spike in the global markets’ volatility, especially in Asia. The commodity market should continue to be under enormous pressure because of China’s shift from unprofitable infrastructure investments. Then, if we imagine the world after this process when the return on investment is normalized, the export prices from China should increase due to shrinking capacities.

Conclusion

In the short term, the potential policies in China and the United States will reinforce the death spiral of tighter money supply and put pressure on asset prices in China. In the long term, however, the inevitable rebalancing process will result in higher market volatility, lower commodity prices, and eventually higher export prices from China.

Finally, for those investors who are interested in the Chinese A-share equity market, Figure 5 shows the one-year index performance. In my opinion, this is completely out of sync with the underlining economy because 1) a dot-com–like valuation and 2) the existence of controlling shareholders and very limited restrictions on them that has resulted in different agendas and a wild market.